Maiden Midatech results fail to excite market

17th April 2015 12:21

by Harriet Mann from interactive investor

Share on

AIM-listed pharmaceutical company Midatech (MTPH) failed to excite the market with its maiden results since floating on the London Stock Exchange back in December. Although operationally successful, the update highlighted just how far away it is from profitability.

Midatech focuses on the development and commercialisation of nano-medicine for diabetes, cancer, neuroscience and ophthalmology - diseases of the eye. The Oxford-based company acknowledges that many of its projects are in an early stage of development, so carry a lot of risk. To offset this, Midatech looks to acquire later-stage assets, like Q Chip, which was bought with the proceeds of its December IPO.

Catching the attention of Woodford Fund Management, Midatech came to the market last December, raising £32 million. Fund manager Neil Woodford holds a majority stake in the company at 19.99%.

Operating losses surged to £7.89 million in the year, from £4.5 million the period before, and pre-tax losses reached £8 million, representing a loss of 82p per share. Clearly, these could be better, but it's worth noting the company has come in ahead of expectations. Thanks to its IPO, net cash inflow rocketed to £27.9 million from £2.3 million in 2013, taking its cash balance at the end of the year to £30.33 million. The company's broker Panmure Gordon reckons this cash can help with licencing deals later on.

"2014 was a transformational year for Midatech Pharma," says chief executive Dr Jim Philips. "Our growth strategy is based on the maturation of our technology platforms, a clear focus on the key therapeutic areas within our pipeline and on the delivery of strategic later stage product focussed acquisitions."

Midatech was awarded a £7.9 million Horizon 2020 European Union grant, with £3.4 million going directly to the group to help it scale-up its manufacturing. Positive results came from an early OpsiSporin study, which treats eye inflammation, and last month a diabetes research collaboration was signed with an unnamed global pharmaceutical company.

Panmure Gordon reckons Friday's results highlight Midatech's strong operational momentum across the business, but the analysts don't see the pharma company becoming profitable until at least 2016. Pre-tax losses are still set to total £10.6 million next year. But they are upbeat and maintain their 420p target price.

They say: "In our view, Midatech offers investors a unique exposure to the fast-growing diabetes and oncology-related pharmaceutical markets, with its relatively early-stage nature offering significant upside for investors. We repeat our Buy recommendation."

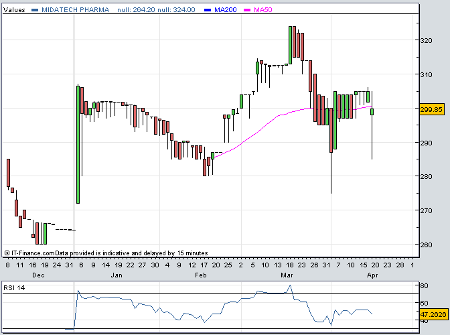

The market wasn't as impressed by Friday's results, and the shares fell 7% to 285p, but this is still 7% higher than its 267p float price.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.