Croda sends our winter portfolio to new highs

22nd April 2015 11:19

by Lee Wild from interactive investor

Share on

Speciality chemicals firm has been a stunning performer over the past six months. Currency concerns have eased, and the exporter of ingredients for make-up, anti-wrinkle creams and industrial lubricants has delivered little but good news. Sales in its high growth markets - North America, Asia and Latin America - are still rising and the Life Sciences division is growing fast.

Sales in the first quarter ended 31 March jumped by 4% to £284.9 million, in line with expectations, and driven entirely by volumes, not price. Profit margin increased "slightly" too. A strong dollar was offset by a weak euro, so the currency impact on sales was negligible. Sales in Western Europe have stabilised year-on-year.

Across the divisions, Life Sciences had a blinder. Sales rose 15.8% at constant currency, and there was also a small currency boost. Pharmaceutical grade Omega-3 sold well, as did new and protected products (NPP) in high purity excipients. Several other products are also moving toward commercialisation.

Personal Care grew sales by 1.8%, or 3.4% if you strip out foreign exchange fluctuations. Sales of new products and sustainable palm oil derivatives did well. Asia and Latin America stood out, while flat sales in western Europe is an improvement.

A dip in demand for lubricants in Europe slowed sales growth at the Performance Technologies unit to just 0.4%, or down 0.7% at constant currency. Sales of polymer additives, however, were strong and management predicts further growth outside of Europe and in the thriving automotive market.

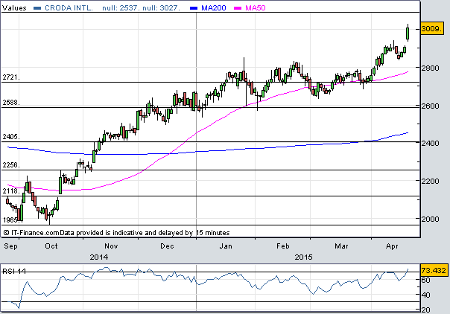

It's almost six months since Croda entered our Winter Portfolio at 2,295p. A few weeks before they had traded as low as 1,988p, so the shares, up 3.5% to 3,009p Wednesday, have risen by more than 50%. They now trade on just under 23 times forward earnings, still not excessive in historic terms for highly-rated Croda.

And there could be further upside from here - Croda shares have risen in five of the past 10 summers and have generated an average gain of 6.6% - and Numis Securities suggests "there could be upside scope to forecasts".

Numis analyst Charles Pick expects pre-tax profit of £250 million in 2015, up 6% on last year, giving EPS of 132p. He has upgraded his target price from 2,643p to 2,906p, too. However, the company’s order book stretches out just one month and comparisons will get harder in the second half, which clearly creates added risk.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.