IAG shares could take off again

1st May 2015 13:06

by Harriet Mann from interactive investor

Share on

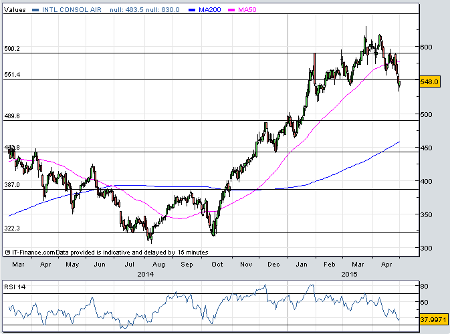

After being stuck on the metaphorical runway for a chunk of 2014, has really taken off. In just seven months the shares have doubled in value and, although they've since retreated from all-time highs, a maiden first-quarter profit yesterday has inspired broker Nomura to slap a 700p ticket price on the shares, nearly 30% more than current levels.

Earnings before interest and tax of €25 million in the first three months of its fiscal year, smashed through analyst James Hollins' forecasts of a €47 million loss. The analyst describes the performance as a "welcome progression", especially with British Airways moving into the black, from a €5 million loss to €117 million profit. Not all sections of the business shot the lights out - Vueling's performance looked flat due to pay increases - but Iberia's losses halved to €55 million.

Although Iberia is still losing cash, Hollins has called its rebrand "fantastic" and expects further revenue and cost benefits to be realised. He predicts full-year operating profit of €2.2 billion, in line with company estimates, helped in part by BA's back-office cost-cutting and improvements to the group's position at Gatwick.

He adds: "We regard the 1Q results as strong, the underlying FY15E guidance (ex-fuel) has risen marginally, and we see real value in the stock now trading at a P/E FY15E of 10.2x (9.0x FY16E), 5.0x adj. EV/EBITDAR (4.6x FY16E), with resumption of dividends for FY15E (2.4% yield) – our EPS CAGR [compound annual growth rate] is 12% for FY15-18E."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.