Making sense of FTSE 100's election day slump

7th May 2015 14:37

by Lee Wild from interactive investor

Share on

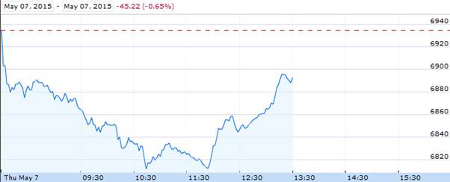

There's been plenty of talk over the past few weeks and months about how financial markets get jumpy at general election time. A closely-fought battle like this one might generate a little extra trepidation. Until last week it looked like traders had held their nerve; the had just made another record high and stocks looked comfortable. But come election day and all hell has broken loose.

By mid-morning Thursday, the FTSE 100 had fallen as much as 123 points, or 1.8%. A disappointing first quarter from , losses at after yesterday's numbers, and weakness at a clutch of heavyweight miners stood out. The leading index is now down over 300 points, or 4.4%, since the 27 April high at 7,122 and has not traded this low since 2 April.

However, more than 80 points of the deficit was reclaimed over lunch, and despite some investors exchanging equities for cash, this sell-off has less to do with the election - only the Dow Jones has done better than the FTSE 100 since the end of March (see chart 2) - and more to do with Greece, a weaker global bond market, and US interest rates.

Chart 1

Netherlands' Minister of Finance and Eurogroup President Jeroen Dijsselbloem has warned that there will be no agreement with Greece when euro zone finance ministers meet on Monday. No one quite knows how the whole situation with Greece will end, but it's unlikely to be pretty either way.

A warning from Fed chairwoman Janet Yellen overnight that equity market valuations “generally are quite high”, plus a reminder that US interest rates will not stay this low forever, spooked markets, too. Wall Street opened lower Thursday.

Chart 2

Back over here, chartist Alistair Strang at Trends & Targets was surprised by today's volatility in London.

"I didn't think today would happen and suspect it's a complete fake as other international markets look like experiencing upward pressure. My cynical attitude suggests watching carefully for FTSE beating 6,900 once the Dow Jones opens."

Strang's initial target is 6,934, with secondary at 6,974. "Usually on general election days, the market finishes flat, hence the 'miracle' expectation. However, if 6,806 now breaks there's a probable bottom at around 6,745 once a fake bounce from 6,785 completes."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.