When to buy oil stocks

8th May 2015 12:50

by Lee Wild from interactive investor

Share on

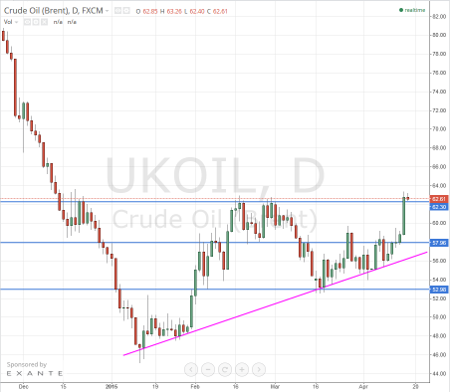

One of the main talking points for investors, other than the UK general election, remains oil and what future direction may mean for stock valuations. Brent crude has risen as much as 55% since early January, and some analysts we've spoken to believe $80-plus within 6-12 months is not so radical.

Morgan Stanley has been 'overweight' in energy within the US stock portfolio this year, underpinned by three key points. On the seven occasions over the past 40 years that energy stocks fell as much as they did in the fourth quarter of last year, they outperformed over the subsequent six months.

Valuation is "compelling", too. But Morgan believes that the time to buy these stocks which has "historically been most prudent" is two months before estimates bottom.

"By the time Brent rises, the companies report, and analysts raise numbers, much of the upside can be earned," writes Morgan analyst Adam Parker.

European energy stocks were upgraded to 'overweight' by Morgan back in March in a bid to gain exposure to value. And they remain very much in play. "Despite the recent rally in the sector, relative valuations still look attractive with a relative dividend yield at its highest level since the mid-1980s," says Parker.

"In addition, the sector is still widely unloved by investors and we expect earnings revisions to turn positive in the coming months due to commodity price strength."

Also keep an eye on government bond markets. Bond yields have risen sharply recently as higher oil prices dampen concerns about deflation, which should benefit the energy sector, according to Parker. "In the bond yields spikes in 1984, 1994, and 2004 energy was the best performing European sector."

Source: TradingView

Morgan's commodity strategy team expects the oil price to trend high again over the next year or so, but likely with the usual fits and starts. "This is setting the sector up for a rare confluence of rising prices and falling costs," it says. "This combination could result in a meaningful recovery in earnings and free cash flow. From their currently depressed levels, we believe shares are likely to respond positively to this."

Its expectations are based on the industry's response to the oil price collapse of 1986, which has strong similarities with the current situation. Then, the oil majors slashed costs aggressively and improved capital efficiency.

"We believe a similar dynamic is unfolding today, which sets the sector up for a historically rare confluence of rising prices and falling costs," believes Morgan. "This combination has the potential to drive significant yield contraction in the majors, and NAV expansion among the E&Ps. From depressed expectations, it can drive a rebound in oilfield service stocks."

Do not expect a v-shaped recovery, but the broker still thinks underinvestment could ultimately push Brent toward $85 a barrel in 2017/18, despite a stronger dollar, before a supply response pushes prices down again.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.