Is this AIM-listed oil explorer worth 563% more?

12th May 2015 14:07

by Harriet Mann from interactive investor

Share on

has just received the competent persons report (CPR) on its Frontier Exploration Licence 3/13 (FEL 3/13), off the west coast of Ireland. And it looks good. The unrisked mean resource estimate has jumped by a fifth to 1.49 billion barrels of oil equivalent (bboe) from 1.25bboe previously, and the explorer now has three drill-ready prospects here. One analyst is certainly happy and thinks the shares could be worth almost seven times the current price.

The "best" estimate is for 861 million barrels of oil equivalent (mboe) at the licence, with Europa's 15% stake in the prospects worth net mean prospective resources of 225 mboe.

"These are very significant volumes of hydrocarbons," says the company. "Europa considers the prospects to be at drillable prospect status and we will update the markets when the operator Kosmos [85% interest] provides more clarity with respect to drilling plans."

"This CPR provides a strong endorsement to our long held view that the Porcupine Basin has the potential to become a major new North Atlantic hydrocarbon province."

Europa will not have to fork out any cash for a while as it is 100% carried on the first well up to $110 million by the operator. Kosmos is breaking the industry trend by increasing capex budgets, and should be able to take advantage of lower costs. Europa has already identified a location for the play-opening well in the Beckett, Wilde and Shaw prospects. That, however, needs to be reviewed with Kosmos, which has suggested drilling on a prospect in either FEL 2/13 or FEL 3/13 may take place in 2017.

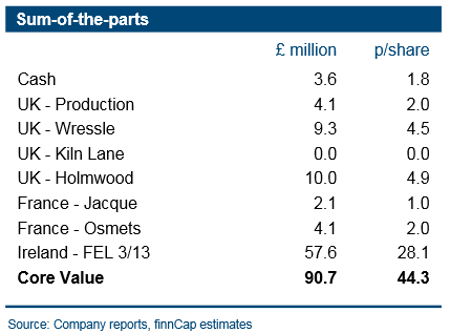

Dougie Youngson, an analyst at house broker finnCap, now thinks Europa Oil and Gas shares could be worth as much as 44.3p, up from 16.2p previously. That's because he's included FEL 3/13 in his core valuation for the first time (see table below).

"Our pre-drill RENAV [Risked Exploration Net Asset Value] for this licence is c£230m," he says. "However, given that Kosmos has yet to make a drilling decision and is also seeking a farm-in partner we have risked this valuation by 75%. We would reduce this figure once a decision and/or partner has joined the joint venture."

There are three known share price triggers coming up in the remainder of this year, which are the Wressle extended well test, an update to the FEL 2/13 licence and developments to the French farm out, says Youngson. After a successful drilling campaign at Wressle earlier this year, the well test will run for two months from May.

Europa shares shot up as much as 22% on Tuesday to 7.75p. They did trade as high as 42.5p in 2011 when Europa was drilling its West Firsby-9 well in Lincolnshire. But those gains disappeared quickly when bad winter weather hit production and output has never really lived up to expectations. Since then the shares have barely broken above 14p.

Getting back to previous highs will be a big ask, then, especially as the geological chance of success at the three FEL 3/13 prospects is put at just 13-19%. Remember, too, that drilling is unlikely to begin for at least another 18 months, possibly longer.

This is certainly not a share for widows and orphans.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.