Fund profile: CF Woodford Equity Income

15th June 2015 09:10

by Rebecca Jones from interactive investor

Share on

One of the most hotly anticipated fund launches of recent times, was launched in June last year with a record £1.6 billion of assets under management.

Since then the fund has swelled to close to £6.2 billion, making it the second biggest fund in the Investment Association's (IA's) 88-strong UK equity income sector in the relative blink of an eye.

This deluge of assets is due to the gilt-edged reputation of manager Neil Woodford, who blindsided the investment industry in October 2013 by announcing his impending resignation from Invesco Perpetual - where he had been for over 25 years and where he made his name as one of the best fund managers in the business.

Industry admiration for Woodford can veer toward the sycophantic; however this is not without merit.

No surprises

His flagship Invesco Perpetual fund - - is a case in point; launched in 1989, Woodford made investors an astounding 1,688% on their investment by October 2013, turning an initial £10,000 investment into £178,800.

This compares to 669% from the average UK equity income fund over the same period and marks Woodford out as one of the UK's most successful asset managers.

After decades of following such an evidently successful investment strategy, it is no surprise that Woodford decided to stick to it.

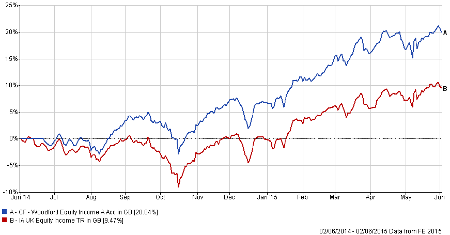

(click to enlarge)

At launch CF Woodford Equity Income's portfolio largely resembled those of his Invesco Perpetual funds: mega-cap "defensive" companies at the top with a few relatively tiny holdings in small and early stage UK companies at the bottom.

"The fund may have been new but it adopted the same philosophy and long-term approach that had underpinned my 30-year-plus career," says Woodford.

"I invest in a company only when I am convinced of the compelling long-term opportunity, but I also have to consider how the global economy influences the stocks I own and the ones that I don't."

Top holdings

Upon launch, the fund's top 10 was dominated by familiar names: pharmaceutical giants and ; tobacco majors , and ; and aerospace engineer to name a few - all of which were former holdings.

Today the portfolio remains largely unchanged at the top, with AZN and GSK remaining Woodford's largest holdings at 7.2% and 7.1% of the portfolio respectively. The tobacco majors have shifted around a bit while Rolls-Royce has dropped out of the top 10 and has moved up a little - not much to report.

Woodford comments: "Turnover has been characteristically low, reflecting our long-term investment horizons. We have continued to build exposure to several core holdings, focusing particularly on those that have displayed periodic share price weakness. This includes GlaxoSmithKline, and Rolls-Royce.

"Elsewhere, we added new positions in the form of (a cash-generative business with an opportunity to deliver a better, lower-cost service to its customers and generate sustainable shareholder value) and engineering outsourcing business ," he says.

This stable positioning has undeniably paid off. In the year to 2 June (the fund's anniversary) CF Woodford Equity Income delivered a sector-busting 12-month return of 20%, making it the best-performing UK equity income fund over the period.

The top half of the portfolio also reflects Woodford's bearish view on the global economy. As he has expressed for a number of years, the manager is concerned about the road ahead for some of the world's biggest economies following unprecedented monetary easing.

"The portfolio that took shape last summer reflected the cautious view I had on the global economy at that time - it is a view that I continue to hold today. We see a challenging future for the global market, corporate earnings and indeed for equity markets which have been inflated by successive and substantial injections of liquidity through quantitative easing.

"'Nevertheless, we have built the portfolio around attractively valued businesses that can deliver sustainable long-term growth in spite of the difficult economic environment," says the manager.

Tailwinds

Arguably more interesting on a portfolio level are the manager's smaller positions. Since launch, CF Woodford Equity Income's portfolio has grown from 61 holdings to 93 - a 53% increase and largely attributable to Woodford's penchant for smaller, early-stage healthcare and biotechnology companies.

Even the most cursory glance over the full portfolio (Woodford is one of the few managers to publish all of his holdings) reveals how busy he has been in this area.

Of the bottom 47 stocks in the fund, 23 are in the healthcare sector and all have names suggesting cutting-edge medical technology: , , , Advanced Plasma Therapies and so on.

This is no big secret; the manager made his intentions to invest in these types of companies clear when he moved himself and his new business to Oxford in order to be close to the medical science department of Oxford University.

Woodford is also passionate about technology firms and alternative finance providers (especially those reaching a new audience of savers and investors through the internet), which again is evident in the portfolio breakdown.

On his move to Oxford, Woodford has long expressed his relief at being away from the "noise" of London's financial district. He is also more comfortable in his own firm, where he says he feels better supported.

"I have greater dedicated resource than I did previously. I work very with closely with my investment team - Stephen Lamacraft, Paul Lamacraft and Saku Saha - talking through ideas and challenging decisions.

"'They don't have their own funds to run. This means I work with three fund managers whose sole responsibilities are to provide me with the analytical and research support I need to manage my portfolios," says Woodford.

Over the next year the manager will have his hands full as CF Woodford Equity Income continues to grow apace and his newly launched investment trust - - gets off the ground. However, as the above fund name would suggest, his patient, long-term approach should hold him and his investors steady.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.