Vedanta is winner from merger deal

15th June 2015 12:25

by Harriet Mann from interactive investor

Share on

Speculation last week that subsidiaries - debt-laden miner Vedanta Limited and cash-rich oil company Cairn India - are to merge proved spot on. Both boards are recommending the deal, but it's controversial, and shareholders at Cairn will need some convincing.

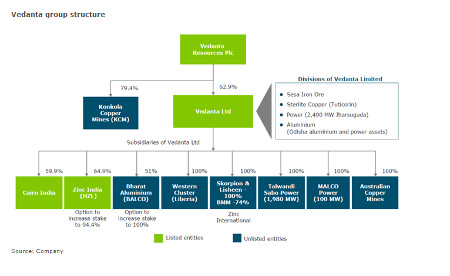

Minority shareholders at Cairn India - bought by billionaire Anil Agarwal in 2011 - each receive one Vedanta Ltd share plus one 7.5% redeemable preference share (RPS) for every Cairn share they hold. That will give them a 20.2% stake in the enlarged company. Vedanta Ltd will own 29.7%, which could be a sticking point. The reverse takeover will shrink Vedanta Resources' ownership in Vedanta Ltd from 62.9% to 50.1%.

"We concede the upside potential for these assets but note that this also exposes Cairn's minorities to substantive business and balance sheet risks," write analysts at Barclays. "Thus, despite being widely expected, the deal may be disappointing for Cairn’s minorities - a majority of whom must approve it for the deal to proceed."

There's a vote pencilled in for the fourth quarter ahead of anticipated completion at the beginning of 2016.

(click to enlarge)

Yes, the deal will help Vedanta Limited finance its Tier-1 portfolio of assets, allocate capital to its highest-return projects and keep up a strong dividend programme. But some in the City still reckon Cairn India, whose shares are at a weak point right now, is getting a raw deal.

Clearly, there's a benefit for parent Vedanta resources when it needs support for servicing its $5.3 billion debt pile, and Cairn shareholders are clearly worried about a raid on their substantial cash pile.

Valuing Vedanta's businesses at 8-10 times enterprise value/cash profits - excluding its stake in Hindustan Zinc - the merger exposes Cairn's shareholders to significant business and balance sheet risks given its reliance on commodity prices, says Barclays analyst Somshankar Sinha. However, there is upside potential to Vedanta's Tier-1 assets and they do at least provide the oil company with portfolio diversification.

(click to enlarge)

Broker VSA Capital isn't confident, either.

"VED remains highly leveraged with debt to equity currently 3.4x and this remains the focus of management going forward. While VED has stated the benefits of consolidating Tier 1 assets and potential synergies we continue to believe the scale of capex cuts required to deleverage VED will negatively impact the company’s medium term outlook and we remain negative on the stock."

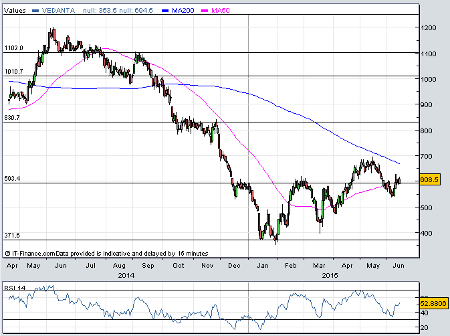

Indeed, shares in Vedanta Resources have given up early gains, and are currently trading flat.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.