Insider: Wikipedia founder buys People's Operator, Unite Group

26th June 2015 12:04

by Lee Wild from interactive investor

Share on

Wikipedia man buys The People's Operator

For a company backed by Wikipedia founder Jimmy Wales and boasting a board packed with blue-chip talent, The has remained off the radar of many investors. It's a mobile virtual network operator (MVNO) - it sells pay monthly and pay-as-you-go mobile contracts - but 10% of every customer's bill goes to good causes.

Founded in 2012, it raised £20 million at 130p from an IPO in December. That money will bankroll development of a viral, on-line global community platform which it is hoped will drive subscriber numbers to one million over the next four years.

And the board are certainly an influential bunch. Among the non-execs is Marisa Cassoni, former finance boss at John Lewis and . She's joined by private equity man and non-exec Gary Hughes, and Christian Hernandez Gallardo, who has held senior roles at , and .

Now, executive chairman Wales has dug deep and spent £104,000 on shares in The People's Operator. He paid 130p each for 80,000 shares, taking his stake in the business to almost six million, or 7.77% of the company.

(click to enlarge)

The purchase comes six weeks after the company said it had over 14,000 subscribers at the end of December - more than expected - and that numbers have more than doubled since year end to about 30,000. Average acquisition costs of £7 are way below industry standards and revenue grew sixfold to £423,391. Losses swelled to £2.3 million, but there's still £18.4 million of net cash on the balance sheet.

"With the imminent launch of the social network and the US platform, near-term newsflow is expected to be lively and positive," said Andrew Darley at broker finnCap. He thinks the shares are worth 250p.

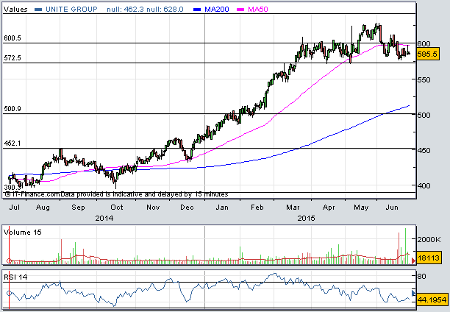

Unite chief makes £1.1m from students

The rush for shares in student accommodation provider has resembled last orders at the Union bar. They're up fourfold since 2011 and 50% since last summer as the government plans to remove the cap on student numbers. More students - an estimated 60,000 a year - means higher demand for student accommodation.

However, chief executive Mark Allan and his wife will definitely not be living like students after selling 30% of their shares.

Mr Allan, who has spent 16 years at the firm and nine as boss following a three-year stint as finance chief, sold 182,000 Unite shares at 584.75p each. Wife Joanna sold 12,000 at the same price. That nets the Allans over £1.1 million. The other 455,534 shares are currently worth almost £2.7 million.

Earlier this week, Allan acquired 40,469 shares at nil cost after he exercised share options linked to the company's 2011 performance share plan.

(click to enlarge)

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.