Greece nerves trip FTSE 100

26th June 2015 13:14

by Lee Wild from interactive investor

Share on

Talks between Greece and European negotiators will rumble on over the weekend. Technical teams are due to lock horns again on Saturday, and German Chancellor Angela Merkel appeared to warn that an agreement must be reached before markets reopen again on Monday. Investors are taking no chances and are reducing equity positions just in case.

Indeed, European stockmarkets fell again Friday. The had lost as much as 76 points by 10am at 6,731, and although there has been a partial recovery since, money is coming off the table.

Month-end IMF payments are due on Tuesday 30 June and the Emergency Liquidity Assistance (ELA) cap for Greek bank funding could be turned off next week.

Deutsche Bank strategist Jim Reid still thinks a last minute deal is the most likely outcome, but wouldn't bet the house on it.

"If there was ever a situation that could bring an accident then no-one would really be shocked if it was this one," he writes. "If there was an accident, expect markets to have a period of notable instability but one would think that central banks would flood the system with even more liquidity if things escalated."

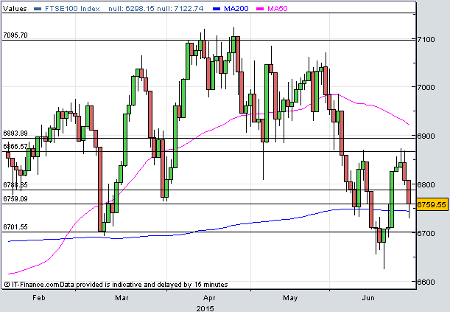

Source: Sharepad.co.uk

"Given this and the reduced contagion risks now vs. 2011/2012, the negativity should last days or weeks rather than months."

On the other hand, strike a deal over the weekend and a "big relief rally" is odds-on.

Technical analysts at regular Interactive Investor contributor Trends & Targets have kindly provided the key price points for the FTSE 100 right now (see chart below).

"Moves now below 6,789 have 6,759 with secondary 6,701, or 6,423 if Greece slips," says chartist Alistair Strang. "The alternate is of growth above 6,866 giving 6,893 with secondary 6,925. Or 7,095 if Greece vanishes. Our normal big picture rules say this is going to 6,423 but only needs better 6,872 to trash the potential."

*Trends & Targets give an initial and a secondary price. If the initial is exceeded, it still expects it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.