Who's top of the telecoms operators?

30th June 2015 16:52

by Harriet Mann from interactive investor

Share on

As long as the telecoms market remains rational and prospects of M&A continue to lend hope of market repair, the outperformance of UK companies will continue, reckon analysts at Barclays, despite its fragmented composition.

At the moment, costs are keeping a lid on returns, but as revenue and cash profit outperformance continues, return on capital in the UK should beat European markets. The analysts have pencilled in 2.2% compound annual growth rate (CAGR) in the UK, versus 1% for the other main markets.

"In terms of revenues, the UK has been the standout performer in Western Europe, growing at 4-5% since 2013," says Barclays. "The increase has been largely driven by BT’s consumer broadband and TV business, which has seen inflationary ARPUs [average revenue per user] as well as strong net adds performance. With price hikes already announced by , and Virgin Media for 2015, the UK fixed market looks particularly strong."

Within the UK, it's largely a two horse race, with and Sky fighting to drive customers on-net to the bitter end. As it stands, both are keeping a cool head in regards to pricing, but should any desperate price cuts find their way into the market, this could all change. Although significant differences in content and promotional activity make price comparisons between the pair quite difficult, Barclays analysts have discovered clear trends.

BT's triple-play offering is attractive for Fibre and "limited Sports", but there is a big gap between its promotional and constant pricing compared to peers, argues Barclays. Its sport proposition is used as bait to attract customers to its TV platform. Compared to Virgin Media and Sky, BT looks cheaper, although Virgin boasts of higher speeds and Sky has a better content line-up.

(click to enlarge)

But BT will have to wait until its merger with EE closes before it can unveil its final converged strategy. Combined, the group has 8.6 million broadband subscribers, representing 36% of the market. This is followed by Sky with 22% of the market, Virgin Media with 19% and TalkTalk with 18%. Compared to peers, has launched a consumer broadband position - although this could be defensive rather than disruptive - and Virgin Media has an established mobile offering. TalkTalk has just launched an aggressive pricing scheme, with a £12/month tariff for unlimited voice, SMS and data - that's going to be hard to compete with.

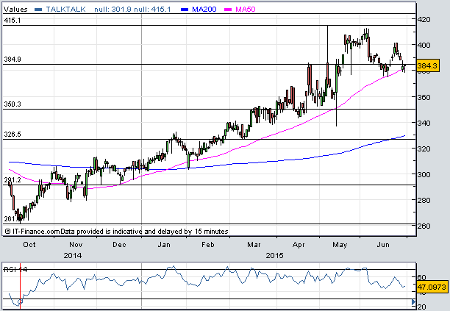

Talk Talk is Barclays' clear value play as it continues to grab market share, despite its weaker fibre and sports demographic. Says Barclays:

We recently hosted meetings with Director of IR and corporate Development, Mal Patel. We believe TalkTalk is well placed to create material value from mobile, benefit materially from remedies from the various UK mergers underway (BT/EE, 3UK/O2), with scope for both improved MVNO [mobile virtual network operator] wholesale terms, and also spectrum.

(click to enlarge)

BT Group, 464p

Target price: 600p,

Recommendation: Overweight

Why Overweight?

Improving operational performance and continued cost cutting can improve free cash flow generation at BT. The pension position is also likely to have materially improved by the next review, enabling BT to increase dividends and deleveraging.

TalkTalk Telecom Group, 389p

Target Price: 500p

Recommendation: Overweight

Why Overweight?

Our positive stance on TalkTalk revolves around its ability to extract costs out of the business, to drive higher margins and hence cash flow. Also, we see upside from the company deploying a data MVNO model.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.