Lloyds is big loser in Budget tax grab

9th July 2015 13:37

by Lee Wild from interactive investor

Share on

Chancellor George Osborne's Summer Budget had plenty in it for the banks to chew over. A decision to slash the complex Bank Levy and introduce a new tax on bank's UK profits will have implications for every lender. But having run the numbers overnight, City number crunchers have revealed that some will suffer much more than others.

As we reported yesterday, Osborne announced a phased reduction of the unpopular Bank Levy between 2016 and 2021, from 0.21% to 0.1%. And from 2021, UK headquartered banks will only be levied on UK balance sheet liabilities, not on overseas subsidiaries.

However, in the first Tory Budget for over 19 years, the chancellor also warned that a new 8% tax on bank profit will be introduced from 1 January next year. Overall, the government expects changes in this Budget to raise an extra £2 billion from the banks over the forecast period, but many in the City think it will be much higher.

"Over the period 2016-21, we estimate that the additional tax borne by the large UK banks could be £2.8 billion," writes RBC Capital. That's equivalent to 1.9% of net profit. The broker estimates that the cost of the 8% surcharge could be as a colossal £9.4 billion.

(click to enlarge)

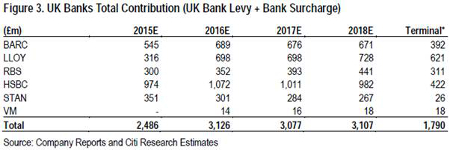

Citi puts the bank levy charge for the large five UK banks at around £2.5 billion in 2015, but predicts that the cost of the proposed new tax rules - total contribution from bank levy and tax surcharge - will increase that to over £3 billion by 2018, and only drop below £2 billion from 2021.

Clearly, the domestic UK banks will bear the brunt of the new tax regime. According to Citi, contribution would more than double from an estimated £316 million this year to over £700 million by 2018 (see table below), as the new tax easily offsets the reduced levy.

True, the insurance division chipped in £0.9 billion of Lloyds' £5.1 billion adjusted pre-tax profit in 2014, but its heavy domestic focus counts against it here. "Lloyds bears the brunt of the surcharge for the industry given the size of its UK profits," reckons RBC. "We estimate that 95% of its adjusted PBT (ex UK bank levy and UK conduct provisions which are not tax deductible) is earned in the UK, leading to a surcharge of £3.7 billion."

(click to enlarge)

For , about 97% of profit is generated in the UK, for it is 44%, 11%, and 5%. "We estimate that the hit to cumulative earnings could be highest at RBS at -8.1%, followed by Lloyds at -6.6% and Barclays at -1.5%. HSBC and Standard Chartered would be net beneficiaries with an estimated uplift to earnings of +1.8% and +4.9%, respectively."

That the scope of the bank levy is being limited to domestic balance sheets is a clear benefit for international banks like HSBC and Standard Chartered. Despite having to wait until 2021 until overseas liabilities are exempt from the levy, RBC thinks the benefits will be substantial. For HSBC, the levy could fall from $1.5 billion to $0.3 billion and plunge by 90% at Standard Chartered to just $55 million.

This move by Osborne could be the clincher for HSBC and ensure that the bank shelves plans to move its headquarters from Canary Wharf to the Far East.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.