SuperGroup becomes Trendy in China

9th July 2015 14:18

by Harriet Mann from interactive investor

Share on

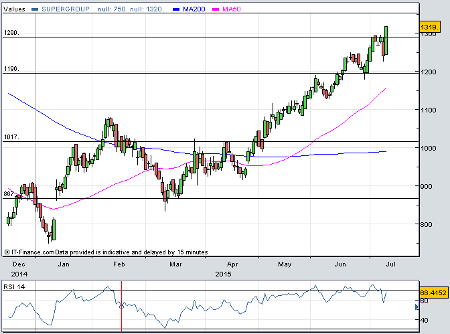

Impressive sales growth, better-than-expected results and news of a promising Chinese joint venture has put a rocket under share price. It's something of a bounceback following a slow start to the year, and analysts have lifted forecasts in response. Even after rising over two-thirds since early January to 14-month high, the SuperDry owner's recovery may have further to run.

After his brief stint at the Co-op Group, chief executive Euan Sutherland is clearly having an impact. Both sales and profits are rising, and he's just nailed a 10-year 50:50 tie up with China's Trendy International Group. SuperGroup will stump up £18 million, but the joint venture should be self-funded within two years. Couple this with the buy-out of its US licence partner in March and promise of a maiden dividend for 2016, and investors are right to get excited about prospects.

Last year's mild autumn - the warmest on record - capped growth in sales for the year to 25 April at 13% to £486.6 million. But gross margin improved by 120 basis points to 60.9% and underlying pre-tax profit rallied 2% to £63.2 million, driving earnings per share up 2% to 59.1p. Reported profit jumped from £45.2 million to £59.5 million. Less cash was generated from operations, however, and year-end net cash dipped 10% to £77.6 million.

(click to enlarge)

"Whilst our financial results fell short of the expectations that the board and our shareholders had at the start of the year, I am confident that SuperGroup has finished the year in a much stronger position," said chairman Peter Bamford.

Operationally, the year was a success, with retail sales up 17%, or 4.8% on a like-for-like basis. Online sales rose over 18%, too, but the roll-out of physical stores also continues apace. And against weak comparatives, retail sales have jumped 35% in the first ten weeks of the new financial year to £60.8 million. That's up 20% on a like-for-like basis.

Looking ahead, broker Peel Hunt is keeping their eyes open for upgrades in the crucial retail periods against weak autumn comparatives and the potential for special dividends. Operationally, the group is tipped to enjoy good growth, with founder Julian Dunkerton back designing and with the Hollywood actor Idris Elba's designs to hit stores in November.

Despite its history tarred by several profits warnings and accountancy issues, SuperGroup's share price has surged and is up 6% Thursday, and they now trade on about 20 times forward earnings.

However, that's a discount to international peers and Investec's Kate Calvert reckons the shares are worth 1,450p.

"We believe SGP's global growth opportunities remain undervalued. It is an early stage roll-out story with potential to double its UK & European owned store base, plus franchise growth opportunities and longer-term upside from the US & now China. Also, we believe there is a material opportunity to improve UK profitability," says Calvert.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.