Why Sky is worth an extra £7bn

14th July 2015 14:31

by Lee Wild from interactive investor

Share on

The death of pay-TV has long been predicted by many of the market's Mystic Megs, but, luckily for , convergence hasn't played out as expected. The satellite broadcaster has been quick to take advantage of this diversion, and its feud with is cooling, too. It's why Deutsche Bank has just upgrade earnings forecasts and slapped a 1,500p price target on the shares, implying over 34% upside.

Initially, commentators believed consumers would move to watching whatever content they wanted, wherever and however they wanted to, leaving Pay-TV redundant. Instead, demand for online video was delayed, while the need for mobility - accessing the internet on the move - has overtaken expectations. The use of tablets and smartphones rely on a mix of satellite, WiFi and mobile networks, which is economical for small audiences but not for the masses. This has increased barriers to entry in Pay-TV, but as rights holders ignore the consumer, operators like Sky are becoming more valuable.

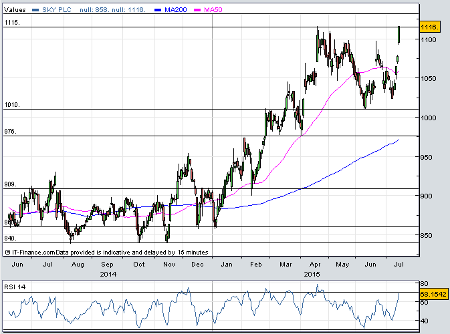

(click to enlarge)

Thanks to its ownership of fixed network assets and enhanced mobile offering, Sky now has exposure to five new income streams - incremental OTT (over the top TV) subs, the online DVD market, paid for mobility products, mobile launch and targeted advertising. But that's not all. Deutsche Bank analysts still think there is life left in triple play growth - broadband, TV and phone - although the demand for mobility favours quad play - adding wireless capabilities. Its stronger core subscriber base also supports higher prices and subscriptions, with growth of 7% pencilled in for 2016, growing to 11% the year after.

Sky shares have underperformed the FTSE 250 and media peers, and investors are cautious. But with strong growth predicted, Deutsche Bank analysts have upgraded the shares from 'hold' to 'buy'. The group is now expected to have generated £11.4 billion sales in the year to June 2015, which should grow to £13.7 billion by 2018, driven by the UK. Expect an increase in pre-tax profit of £1.15 billion this year to £1.4 billion in 2016.

With rights to the Premier League, major sporting streaming and studios locked down by between Sky and BT, the pair should be entering a period of calm. The analysts are adamant this isn't a truce, but growth in pay-TV and the quad play market over this quieter period should offset Premier League inflation. Sky forked out £4.2 billion for Premier League rights in February, and costs are set to rise by another 83% in 2020. Deutsche Bank still forecasts 17% EPS growth over the next five years, however, which is impressive. Sky also has access to the German and Italian markets, which aren't as competitive as the UK, where barriers to entry continue to rise.

The shares rallied 3% Tuesday close to a 14-year high, putting the shares on 17.3 times EPS estimates for 2016. Of course, there are risks, including the impact of missing out on Champions League football on the UK and Italian business, regulation and acquisitions. But Deutsche Bank remains bullish:

"It is high-quality, defensive-growth with growing 4-5% dividend yield. Why should it not trade at consumer staples multiples? We value at 17x CY18E P/E. Reed and PSON trade at 14x but are slower growth, consumer staples at 20x."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.