Share of the week: Buyers tuck into Just Eat

17th July 2015 17:17

by Harriet Mann from interactive investor

Share on

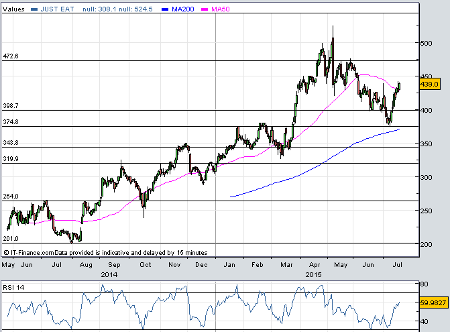

Investors craved this week and the fast-food delivery company, which floated in April last year, is one of the biggest risers on the FTSE 350. The shares have more than doubled over the last year and are way above their 260p IPO price. A flurry of broker attention triggered the 8% five-day surge and Goldman Sachs reckons savvy investors could make another 28% profit.

Just Eat leads the way in 12 of the 15 countries it operates in, which can only benefit the group as more people opt to order takeaways online. As the industry matures, Goldman is confident the group's network effects and platform scalability will drive strong profitability. It's why the shares have been added to its conviction buy list. Last year's impressive cash profit margin of 40% in the UK & Denmark should help plug the losses in other markets, with group margin set to more than double to 44% in 2017.

Clearly, Just Eat needs an impressive tech offering to distinguish it from the pack, but as cheaper smartphones become available across the world, mobile is set to become its most important channel. In 2014, UK mobile traffic increased 61%, with orders jumping by 58%. The business generates a lot of cash - the £58 million expected in 2015 should grow to £135 million in 2017 - which will be important for investment in this area, although it is likely to go on a buying spree.

"We forecast continued strong cash flow generation and do not currently assume any dividend pay-outs or other forms of capital return," explained Goldman analyst Carl Hazeley. "Instead, we believe it is likely that Just Eat will deploy excess capital in M&A opportunities, either to consolidate market positions in its current regions, or to enter a new country in line with the company’s own history and stated strategy."

Not only is Just Eat highly cash generative, but it has negative working capital and low capital requirements. The Goldman analysts forecast compound annual growth rate in sales of 25% from 2014-2020 and 41% growth in cash profit. Their 560p price target represents 28% upside to current levels.

The shares ended the week at 439p, an eye-watering 82 times 2015 earnings estimates. Granted earnings are set to more than halve this year as investment for growth continues, but EPS is then set to bounce by 175% in 2016 and 60% in 2017.