Amino Technologies transformed by latest deal

21st July 2015 14:13

by Lee Wild from interactive investor

Share on

had a decent first-half and is on track to hit full-year forecasts. But it's a "transformational" acquisition that's stealing the headlines and with good reason. The £80 million company - the brains behind internet-enabled TV (IPTV) set-top boxes - is paying $73 million, or nearly £47 million for American rival Entone, and an oversubscribed share placing to part-fund the deal tells us what the City thinks.

Entone provides broadcast hybrid TV, which allows viewers to watch television and access the internet through a single device, and is a market leader in the US IPTV market. It made a cash profit of $5.1 million in the 11 months to May on revenue of $46.7 million. It's a business that Amino - a pure IPTV play - has wanted to get into for a long time. Now, after two years of talks, chief executive Donald McGarva has decided to pay up.

"The acquisition provides an opportunity to consolidate one of the croup's direct competitors and will enhance the move into broadcast hybrid and assist with evolution of HEVC [high-efficiency video coding] and 4K UHD [ultra high definition]," says Amino. "The enlarged group will have a larger global footprint and solutions portfolio and will offer Amino a direct sales route into the US."

A first payment of $65 million in cash will be handed over on completion, expected on 11 August, with the rest paid over the next two years. That represents an historic EV/cash profit multiple of about 11 times, a premium to Amino. The deal will be funded with Amino's £17.3 million cash pile - recued recently by the acquisition of Finnish cloud-TV provider Booxmedia for €7.9 million - bank loans and a £21 million share placing at 130p.

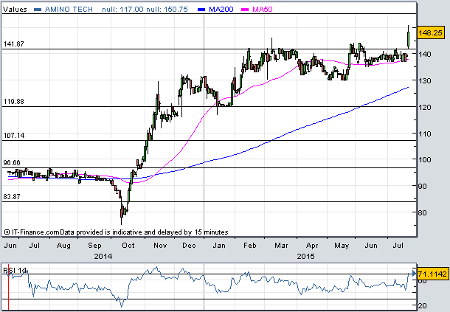

(click to enlarge)

There's a clear opportunity to improve margins at Entone in line with Amino's superior return on sales. Entone's low-cost development in Hong Kong could cut down on outsourcing, money can be saved on software license and overlapping roles will go. In all, Amino reckons it will find £1 million of savings in the first full year of ownership.

First-half results, also announced Tuesday, were worth celebrating, too.

Underlying cash profit for the six months ended 31 May jumped by over a third to £3.9 million, and underlying operating profit was up 60% to £2.8 million. That's before a third and final duty rebate of £0.7 million.

North America was very strong and there are "green shoots" of recovery in the Netherlands, finance director Julia Hubbard told Interactive Investor. Crucially for income investors, Amino repeated its commitment to raising the dividend by no less than 10% a year up to and including the year ending 30 November 2016.

A respectable dividend yield, historically low earnings multiple, and this exciting acquisition bode well for Amino. We suggested in February that, at 125p, the company's potential was not fully appreciated. Now, at 148p - a nine-year high - that could be about to change.