Nikkei buys Financial Times

23rd July 2015 16:33

by Lee Wild from interactive investor

Share on

Just four hours after admitted it was in talks to sell the Financial Times, the education company has confirmed Nikkei Inc will pay £844 million in cash for its newspaper business. It's fair to say the announcement raised more than a few eyebrows in the Square Mile - the hot money had been on German giant Axel Springer - and what about Thomson Reuters or Bloomberg?

As we wrote earlier, there are no prizes for guessing that the FT is being sold. The pink 'un has looked out of place at the increasingly education-focused Pearson, and a sale really is the most logical step. Pearson chief executive John Fallon agrees.

"We've reached an inflection point in media, driven by the explosive growth of mobile and social," says Fallon. "In this new environment, the best way to ensure the FT's journalistic and commercial success is for it to be part of a global, digital news company. Pearson will now be 100% focused on our global education strategy." He'll sink the money into Pearson's "global education strategy".

FT total circulation across print and digital has risen more than 30% over the last five years to 737,000. Importantly, digital subscriptions now represent 70% of revenue. FT Group generated £334 million of sales in 2014 and made an adjusted operating profit of £24 million.

Nikkei, which already has a London bureau a mile away from FT HQ at One Southwark Bridge, will also get magazines like Investors Chronicle, The Banker and Money-Media when the deal completes during the fourth quarter of 2015. But the deal does not include One Southwark Bridge - a great site for luxury flats - and Pearson's 50% stake in The Economist.

The announcement will no doubt be the main discussion point at Pearson's half-year results tomorrow. But there are some key developments investors need to keep an eye on.

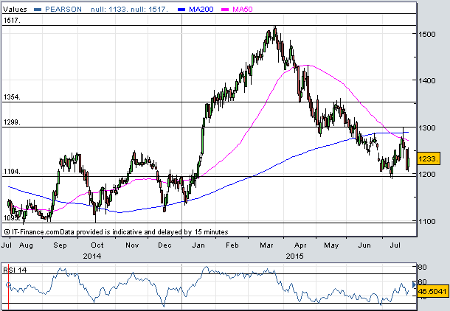

(click to enlarge)

Of particular interest will be news on trading conditions/lead indicators like college enrolments, and progress in contract renewals in North America, says Westhouse Securities at Roddy Davidson.

"Pearson's stock has underperformed the market over a three-month view, taking it close to our 1,185p target price," adds the analyst.

"That said, we remain cautious and believe the risk to our forecasts is on the downside, reflecting a muted trading outlook, the likelihood that evolution of the global learning market from traditional to digital delivery will prove complex, protracted and create genuine execution challenges risk, and the uncertainties highlighted above."

Despite the recent de-rating, Pearson shares are still trading on over 16 times forward earnings. Not cheap.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.