Top tech sectors for value

14th August 2015 17:05

by Harriet Mann from interactive investor

Share on

As the shift from physical assets to technology continues, the noise around Big Data intensifies. Where companies once had to own the assets they marketed, today some of the most popular IPOs have no stock.

Take ; it's one of the most popular media outlets without possessing any content, and is one of the biggest retailers without any inventory, Havas Media senior vice president Tom Goodwin recently told the CFA Society. Uber, which has been increasingly flirting with an IPO, is the world's largest taxi company, but it owns no vehicles.

It's no wonder the tech industry is outperforming the more traditional commodities-based sectors that have been beaten black and blue by a depressed market backdrop.

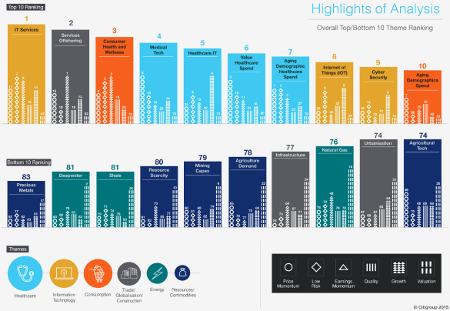

Launched in 2013, Citi's Theme Machine helps investors identify actionable themes, allowing each one to be valued on different financial metrics. Since inception, the top quintile have jumped 36%, whereas the bottom quintile has lost nearly 6%. The analysts do warn, however, that this timeframe has so far been short.

(click to enlarge)

You can see from the infographic above that technology-related and healthcare stocks are hogging the top ten, with IT Services taking the top spot, followed by Services Offshoring, Consumer Health and Wellness, and Medical Tech. Companies offering the Internet of Things and Cyber Security take number eight and nine respectively.

Compare this to the bottom ten ranking, Precious Metals comes in last, preceded by Deepwater, Shale and Resource Scarcity. These laggards shouldn't come as a surprise. There are diamonds in the rough in the commodity sectors, however, with clean water, alternative energy and timber all showing improving earnings momentum.

Citi identifies eight sectors brandishing high momentum - including Biotech, DNA/Genetics and Software as a Service. Only four are recognised for both their value and momentum. These gems are Services Offshore, Aging Demographic Spend, IT services and P&C pricing.

We have taken a look at Citi's top three themes to see where there is value.

IT Services

Returning over 5% since 2009, growth in the IT Services sector is driven by cloud services, the increasing need to be social and big data. It trades at a discount to the MSCI World index, with a forward price/earnings multiple of 14.96 times, despite having more impressive earnings growth of 12% versus the benchmark's 8%. In Citi's coverage, there is only one UK-listed company: . The outsourcer, which runs blue-chip firms' back offices, has been struggling as losses from its procurement business have widened. Still, Citi has a 'buy' rating on the stock with a 700p target price.

The firm is joined by Japanese Fujitsu and US firms and .

"Citi notes that the dramatic growth in the use of mobile computing and connectivity is one of the defining attributes of our time and just as E-Commerce Strategies were a 'must have' over the past 12-18 years, corporate strategies will have to accommodate Mobility in the years ahead," commented the research group. "IT Service companies help facilitate this."

Services Offshoring

Wanting value for money, many companies outsource IT operations to low-cost regions. India, for example, has become a prime location thanks to its low costs but high skills levels. Returning 4.5%, the sector dwarfs the MSCI World index in terms of EPS growth (23% versus 8%) and dividend yield (6% versus 2%). Investors are unlikely to get the same return on equity as the index, unfortunately, but the theme is ranked second by the research group.

No UK companies make the top-ten, which includes Hong Kong-listed Sany Heavy Equipment International, Singapore-listed Ascendas India Trust and US-listed Epam Systems. The theme trades on 15 times forward earnings compared to the MSCI World's 16.42 times.

"Outsourcing and offshoring of IT services are not new, but the secular and cyclical drivers remain in place. Sluggish economic growth forces companies to assess priorities and lower costs. While traditional cost take-out projects continue at a good place, Horizon 2 services, (BPO/Infrastructure), the public sector and Europe have lower penetration rates."

Consumer Health and Wellness

Estimated to be worth around $200 billion, the Consumer Health market is larger than Home Care, but just half the size of Beauty and Personal Care markets. It's surged by nearly 5% CAGR over the last three years, driven by volume growth and pricing power.

Citi is convinced the only way is up in this sector, as healthier lifestyles become increasingly popular and the need to combat obesity rises. Unlike the previous themes, the sector trades at a premium to the benchmark with a price/earnings multiple of 19 times, yet EPS growth of 7% underperforms the market's 8% forecast.

UK-listed made the list, rated 'buy', with a 12.2p target price representing 33% upside to current levels. Joining the group is Australian Speciality Fashion Group and US .

"The consumer health market remains very fragmented, with J&J the clear market leader having just 4% share," explain the analysts. "The top-10 players have just 24.2% of the market, rising to 32.5% if Vitamins & Dietary Supplements (the largest category) are excluded. This is much lower than other HPC categories, creating lots of white space for companies to grow into," the analyst concludes.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.