Crawshaw fulfils promise and doubles

17th September 2015 13:57

by Harriet Mann from interactive investor

Share on

Despite a slower start to the year, fresh meat and food-to-go retailer reckons it will smash market expectations in 2015, thanks to a raft of new management-led initiatives. With stronger like-for-like sales across the chain of butchers shops and a tastier gross margin sending the shares, which traded at just 2p in 2012, to multi-year highs, Crawshaw's re-rating looks to have momentum.

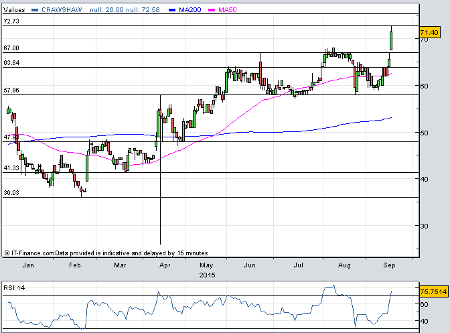

We reported that Crawshaw could nearly double in value to 70p back in February, when the shares were changing hands for just 36p. Fast-forward eight months and the shares have done just that, with Thursday's 10% rally pushing their market value to over 71p.

As well as improving its food range, the butcher's two new stores have gone down a treat and are trading "well above" their base case expectations, fuelling growth across the entire estate. This all comes amid heavier investment in the business, as the group expands its modest portfolio by nearly ten times in the next eight years to over 200 stores. House broker Peel Hunt calls this a "staging post” rather than end target, however, forecasting a portfolio of 500 stores. Crawshaw acquired Gabbotts Farm Limited for £3.9 million in April and now has access to its 11 retail butchers.

(Click to enlarge)

"We look forward to presenting a strong trading position at our interim announcement on 29 September 2015 and now expect the company to exceed market expectations for the year ended 31 January 2016," the firm said on Thursday.

Expecting sales of £35.9 million, Peel Hunt analyst Charles Hall has increased his 2016 EBITDA guidance from £0.8 million to £1 million, with pre-tax profit reaching £0.2 million from breakeven. This will be down year-on-year due to its hefty investment.

"We are leaving our long-term forecasts unchanged at this stage, as the company is stepping up investment in order to execute the roll-out plan. However, this early progress should increase prospects that the plan and forecasts can be exceeded,” he said.

Coinciding with the rising share price, new boss Noel Collett has now had six months at the helm of Crawshaw. He left his role as chief operating officer of the Lidl's UK business, where he tripled the store base to 600. Clearly, he knows what he is doing.

The butcher’s seems to be making a healthy habit of beating expectations, with sales up 17% at £24.6 million in the year to 31 January 2015 better than initial forecasts. EBITDA (earnings before interest, tax, depreciation and amortisation) jumped 15% to £1.6 million and net cash rose from £1 million to £9.1 million.

"Crawshaw plays into the attractive themes of value retail combined with food to go,” says Hall. "The business has an impressive management team, well versed in the challenges of a store opening programme, and this gives us confidence that the rollout plan to reach 224 stores from the current 35 will be successfully executed. We continue to see substantial upside in the shares.”

The house broker analyst discounts his 129p target price to 100p to account for execution risk, although admits this is a cautious view.