Insider: Buyers return after summer break

18th September 2015 13:46

by Lee Wild from interactive investor

Share on

Insider is back after a self-imposed hiatus during what turned out to be a super summer until the heavens opened and global stockmarkets crashed late August.

Company directors, who had been predictably idle during holiday season, are showing signs of life again, manifested in a willingness to build stakes in the companies they run.

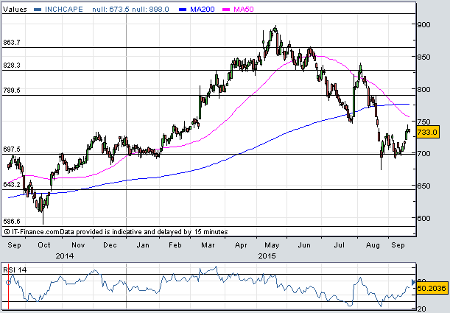

CEO revs up stake in Inchcape

First of note is , the successful car dealer. Stefan Bomhard took over from chief executive André Lacroix, who left to run Intertek, on April Fool's Day. The former Bacardi and Burger King executive has just bought 12,000 Inchcape shares for 733p each worth £88,000, taking his holding to 33,339 shares.

Clearly, Bomhard takes the view that Inchcape shares are cheap. They're down 18% since May and have recently traded near to 2015 lows. That's despite a strong set of half-year results announced in July.

Inchcape made a pre-tax profit of £153 million in the first six months, about £3 million more than consensus estimates. The company did especially well in the last two months of the period, and business in South East Asia is expected to pick up during the second half. That and a £100 million share buyback squeezed upgrades from JP Morgan.

(Click to enlarge)

The broker now expects full-year profit of £303 million in 2015, giving adjusted earnings per share (EPS) of 50.7p. At 733p, Inchcape shares trade on 14.5 times forward earnings. JPM thinks the discount to the sector could narrow as there is clear potential to beat estimates.

Mothercare man backs recovery plan

Mark Newton-Jones has retailing in his bones. After helping run the family retail and wholesale business, he headed up Next Directory then was then handed the top job at Littlewoods and Very owner Shop Direct. In March last year he became interim CEO at before getting the role full-time in July.

Mothercare shares doubled in value between May and July 2014 to 300p, as excitement grew around a turnaround plan and a bid approach worth 275p per share from American giant . But Newton-Jones turned down the offer and instead launched a £100 million rights issue.

And this year, the pushchairs and kid's clothes chain has already enjoyed its annual rally, peaking in July at 298p before a customary decline. Weak demand in the Middle East and less retail space on home soil hit first-quarter sales.

(Click to enlarge)

Still, the boss is backing his own strategy - driving the internet business, improving product quality, remodelling the retail estate and growing overseas sales – with his own cash. After an ill-timed purchase of 17,606 shares at 282p in July, Newton-Jones has spent a further £50,000 on 21,843 shares at 227p. He now owns nearly 249,000 shares currently worth £567,000.

JP Morgan expects adjusted earnings per share (EPS) of 10.5p in the year to March 2016, putting the shares on a forward price/earnings (PE) ratio of 22. However, if all goes to plan, EPS rises to 16.6 the year after when the PE drops a far more palatable 14.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.