FTSE 100 plunges below 6,000

22nd September 2015 13:44

by Lee Wild from interactive investor

Share on

Investors could be forgiven for shaking their heads in disbelief at the volatility of global stockmarkets currently. The Federal Reserve's decision to hold interest rates at close to zero would typically be cause to celebrate. But the FTSE 100 has just collapsed as much as 146 points, or 2.4%, close to 2012 levels, as US futures indicate big losses on Wall Street.

As we reported at the weekend, there are growing fears around the outcome in China as it makes the awkward switch from investment-led to consumption-driven economy. Fed commentary is confusing traders, too. The "will they, won’t they?" debate continues until at least the October meeting of rate-setters. More likely is a rate hike will not happen until December at the earliest

At lunchtime Tuesday not one FTSE 100 (UKX) share could claim gains. has got smashed again as the debt-laden miner tries to survive in an increasingly hostile environment for resource plays. Investors are selling , , and , too.

With Brent crude still glued to $48 a barrel, and are also struggling. Catalytic convertor giant is down over 6%, with investors linking the company with the Volkswagen scandal. The German car giant yesterday admitted it had fixed car emissions tests in the US.

That's also put GKN on the rack. Volkswagen is the largest customer at GKN's division which supplies drivelines to car manufacturers, making up 15% of sales. VW also does business with other parts of the UK engineer. However, UBS thinks the impact on GKN of any action taken against the German firm "is likely to be trivial". A 10% slump in VW sales would nip 0.7% off both the top and bottom line at GKN.

Defensives like and are nursing just light losses.

(Click to enlarge)

It's a fairly light session for data, too. There are US housing figures and the Richmond Fed manufacturing activity index, and all eyes will be on president of the Atlanta Fed Dennis Lockhart who speaks on the US economy later. Lockhart said this week that a first US rate hike in nearly a decade was still likely in 2015 subject to market volatility.

What next? A quick call to our friends at Trends & Targets brings no relief. Technical analyst Alistair Strang told us last week that a cycle bottom of 5,896 was "mathematically available". After a tweak to the model, that number drops to 5,877. "It almost must bounce at such a point, if only to gather momentum for a further drop," says Alistair.

In truth, you could make an argument for a move in either direction. Indeed, the analysts we've reported on over the past few days have done just that.

(Click to enlarge)

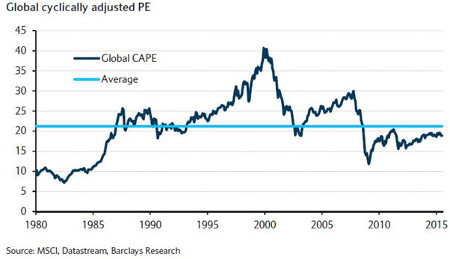

Today, writes that the key to the outlook for global equities is earnings. "With global valuations in line with historical averages, a supportive monetary policy backdrop, and very bearish sentiment, a major hit to EPS is the main risk for the market," warns Ian Scott, head of equity strategy at Barclays.

"[However] history suggests that, if our earnings projections are right, today's extremely negative sentiment towards equities should unwind, with global equities able to recover the bulk of their recent losses over time."

Barclays still thinks the FTSE 100 will end 2015 at 6,700.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.