Is VW crisis an opportunity for investors?

23rd September 2015 15:25

by Lee Wild from interactive investor

Share on

Many UK investors are inclined not to put their money into overseas companies. It's hard enough picking through the bones of a British firm's annual statement and keeping track of corporate events, let alone a business based in another jurisdiction. However, every once in a while, something happens that changes all that. Step forward . Installing clever software to fool car emissions tests will cost it billions of euros and likely see a number of top brass, including CEO Martin Winterkorn, lose their jobs. This scandal is huge, and VW shares have plunged, but it's certainly caught the imagination of investors wherever they might be based.

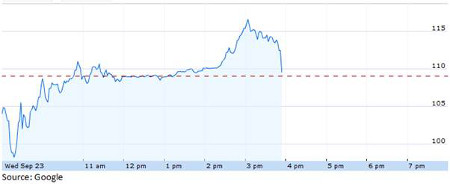

Trading above €250 in the spring, VW traded below €100 a share for the first time since 2011 Wednesday as the Volkswagen board held a crisis meeting at the carmaker's giant plant in Wolfsburg. Before the scandal broke they were worth about €162.

(click to enlarge)

Putting a precise figure on the likely cost to VW in terms of sales and profits is impossible given the situation remains highly fluid. The company, which also owns Audi, Seat, Skoda, Bentley, Bugatti, Lamborghini and Porsche, has already said it will recognise a €6.5 billion provision in its third-quarter results, but initial estimates by industry experts put the likely fine by industry regulators as high as $18 billion. Legal bills could be a further €5 billion. Put in context, last year the company made a pre-tax profit of €14.8 billion ($16.5 billion) on record sales of €202 billion.

But the final bill could be much more. Numbers so far have been based on the potential hit in North America where the emissions cheat on vehicles made between 2009 and 2015 was first discovered. It's a huge setback for VW, which had lost money in the US for years, but has been winning market share and was on track to hit bullish targets there.

However, the main worry is European exposure where VW makes a large chunk of its money. VW made over 10.2 million cars in 2014, of which 4.4 million were sold in Europe. It now admits that 11 million vehicles with Type EA 189 diesel engines which included the illegal software had been sold worldwide, and an EU-wide investigation is inevitable. But of course, first "confessions" are rarely the end of it.

Investment case

It cannot be stressed enough that a lack of clarity makes investing in VW, even at these multi-year lows, high risk. Many analysts have downgraded their recommendations and slashed earnings estimates.

"We think legal and especially operational uncertainty will continue to weigh on the stock which makes pinpointing a 'fair level' a near impossible task and the unquantifiable risk might prohibit several investors to take a position," writes Deutsche Bank.

"We cut our EPS estimates materially over 2015- 2017 accounting for a €5 billion legal fine, recall costs, lower growth and pricing pressure from brand damage (2%). Any €1 billion additional fine would take away €2.02 per share."

Forecasts for operating profit in 2016 are cut by 35% and by 28% for 2017, and the broker downgrades its rating to 'hold' and halves its price target to €130. However, it does acknowledge there is a financial cushion, with net cash put at €12.5 billion in 2016 with a further €3 billion of proceeds is expected from the sale of a 20% stake in Suzuki.

JP Morgan makes big change, too. As well as cutting profit forecasts, it downgrades the shares to 'neutral' with a new December 2016 target price of €179 from €253 before "as we lack clarity on the potential total cost of the recall and the risk of additional engine investigations". But it adds: "The longer term equity story of VW remains intact and ready to revisit as soon as we gain clarity on the engine recall situation."

(click to enlarge)

Over at UBS, the team made only a minor €10 trim to its price target yesterday, which now sits at a still mighty €290. "Despite near term concerns we remain positive on VW as it is one of very few OEMs whose earnings are meaningfully below potential and where we see significant levers to improve operating performance (ex-China) as well as portfolio and capital allocation. On our 2015E, VW is trading on 0.13x sales, 2x EBIT and 6x earnings."

Clearly, there's a view that VW shares are undervalued. And it's true, the initial sell-off can often overshoot to the downside, as good news has a habit of heading too high, too fast. VW shares are currently trading at around €110 and, looking back in 12 months' time these levels may look like a bargain. However, with more questions than answers currently, it remains too early to tell if the rout is over. What is clear is that VW shares will remain volatile, which will be seen as an opportunity by some traders.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.