Eight best blue chip yields for 'safe' income

22nd October 2015 10:13

by Harriet Mann from interactive investor

Share on

It's not been an easy ride for cyclical stocks in recent years. According to broker UBS, their performance has been "nothing short of a disaster". They’re right. Instead, investors have swarmed to defensive yields since the financial crisis and the era of record low interest rates began. But the tide is turning, and there are now "relatively safe" dividends to be found among the cyclicals. In fact, the relative yield is at a decade high.

There are four reasons why UBS likes "relatively safe cyclicals". For one, European dividends are at near-crisis levels, yielding 3.75%. If the worst happens, income should be reasonably stable. The average dividend cut in all recessions since 1970 was 12%, and just 7% excluding 2009.

(click to enlarge)

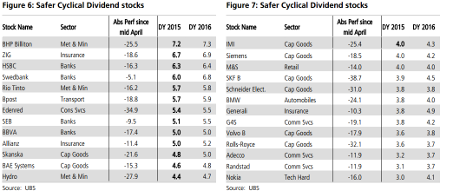

Cyclical yields are also at a 10-year high versus defensive sectors and, crucially, bombed-out commodities are not the core driver. However, the move in cyclical versus defensive yields is driven largely by the underperformance of cyclicals.

UBS also points out that growth expectations for Europe have been reset lower, and the Eurozone economic surprise indicator has rolled over to its worst level this year and since 2009.

But why now?

"The Vix and VDAX [volatility] are still at elevated levels as the world keeps an eye on China/emerging market growth, signs from the commodity space, Fed hikes, political risk and more," says UBS. "With these risks still ongoing, we think it makes sense to select safer cyclicals as the world adjusts to a post BRIC world."

For safer cyclical dividend stocks they point to , which trades on a prospective dividend yield of 7.2% (see chart). A question mark has recently emerged above BHP's impressive yield, as some investors question if the payout can be maintained or whether this cash could be put to better use buying cheap assets.

UBS analyst Myles Allsop says: "We are attracted to BHP Billiton as it has a dividend yield of c7%; we believe this is sustainable and expect BHP to maintain the dividend during the down-cycle due to its strong balance sheet and low cost position, with BHP still having some flexibility on capex and having the potential to positively surprise on cost cutting after S32 spin-out."

Among the UK-listed companies, recently upgraded banking group offers a generous 6.3% yield, and analyst Stephen Andrews believes the risk/reward has shifted to the upside.

"We believe HSBC continues to hold a number of attractive, high return businesses (commercial/retail banking in Asia/UK). But we believe significant restructuring and capital release is required to improve returns and release capital to reinforce the dividend and future capacity for growth," explains Andrews.

Predictably, features, too, yielding 5.7%. Other "safe" UK stocks include defence titan , engineer , high street chain , security firm and struggling plane engines colossus .

Record dividends

That there are such impressive dividend yields to be had is no surprise. Companies paid out a record £27.2 billion to shareholders in the third quarter of 2015, 6.8% higher than the same time last year.

According to Capita's latest dividend monitor, excluding one-off pay-outs, underlying dividends rose 5.9% on the year, while special dividends surged by over a quarter. Most investors have benefited from the strong dollar, given that a number of the UK's largest companies declare their dividends in US dollars.

While the supermarket wars have wreaked havoc for income investors, the financial sector led the way again. The asset services group warns investors to be wary of commodities, however, as this maintained momentum may not have legs.

“Income investors have had terrific dividend pay-outs in 2015 so far, shrugging off some high profile casualties like Tesco," explains Justin Cooper, the boss of Shareholder solutions, part of Capita Asset Services.

"But the outlook is gloomier. Profits are lower relative to dividends than at any time since 2009, and we have seen some of Britain’s biggest dividend payers announce drastic cuts for the year to come, with the prospect of more to follow."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.