Ryanair profits explode on cheap fuel and summer rush

2nd November 2015 14:14

by Harriet Mann from interactive investor

Share on

With another "excellent" six months under its belt, has stepped up its expansion plans and turned more bullish on profit forecasts. As the first EU airline to carry over 10 million passengers in one month, the low-cost carrier attributes the pick-up in traffic on lower fares. And with weak oil prices expected to keep ticket prices low, traffic volume targets have been raised yet again.

Traffic rose 13% to 58 million in the six months to 30 September and the load factor - a measure of how well it fills its planes – rose four points to 93%. Crucially, Ryanair boss Michael O'Leary managed to increase average fares in the period by 2% to €56 - sales jumped 14% to over €4 billion - while at the same time cutting costs by 6% due to cheap fuel. It's why first-half profit after tax leapt 37% to €1.1 billion.

Profit surprises have become more frequent at Ryanair in recent times. In September, the firm reported a strong summer as it upgraded forecasts for full-year net profit to between €1.175 billion and €1.225 billion, up from the old estimate of €940-€970 million. Now, it thinks profits will be "towards the upper end" of that range.

That, however, is heavily dependent on strong bookings in the fourth quarter. Despite "almost zero visibility" for the three months, Ryanair still hopes to deliver traffic growth of 22%. It says forward pricing has softened in recent weeks, too, with third quarter average fares expected to be flat against last year and fourth quarter fares expected to fall 4%.

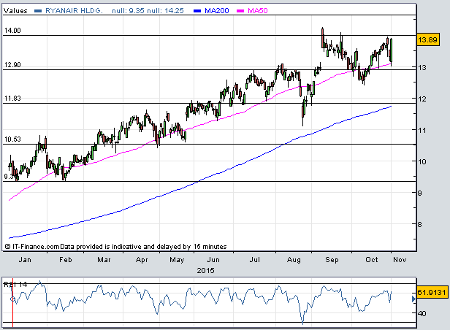

(Click to enlarge)

Expectations for full-year traffic volumes can't sit still, either. Another upgrade to 105 million for the year to March is 16% higher than last year's 90.6 million. Double-digit full-year traffic growth is pencilled in for Ireland, the UK, Spain, Italy, Portugal, Poland, Germany, and Denmark, and Ryanair will open four new bases and 119 new routes this winter.

Taking advantage of further oil price weakeness over the summer, Ryanair has hedged 95% of its 2017 fuel at an average rate of $62 a barrel. This should deliver savings of around $430 million, which should be passed onto customers in the form of lower fares as it grows capacity.

"Looking beyond the current year, based on these stronger than expected load factors, we have raised our long term traffic target from 160 million to 180 million customers p.a. by FY24," said the group.

Panmure Gordon analyst Gert Zonneveld remains bullish on the Irish airline: "Long term prospects remain highly attractive as the company continues to broaden and deepen its pan-European network," he explains. "The balance sheet remains very strong with net cash of €976 million at the end of June 2015 and the company continues to return excess capital to shareholders on a regular basis (c.€2.9bn since 2007/08)."

Zonneveld keeps his 'buy' recommendation and €16.5 target price, implying significant upside to the current share price, up 3% Monday to €13.89. That puts the shares on over 15 times forward earnings, which does not look excessive if Ryanair continues to do the numbers and the stockmarket avoids a major correction.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.