Weir and Hunting reflect oil trouble

3rd November 2015 13:47

by Harriet Mann from interactive investor

Share on

The devastating effect of low energy prices on oil industry profits is obvious. Third-quarter results season has thrown up plenty of howlers, with sector earnings down by 54% year-on-year.

Many companies have relied on strong downstream (refinery) performance and working capital relief to offset the pain, but broker Barclays warns this will weaken over the fourth quarter, meaning even greater dependence on cost savings. It could also spell further bad news for beat-up oil services players.

Last year's collapse in oil prices shows little sign of reversing, and the cost of a barrel of Brent crude is stuck below $50. Companies have had to adjust to making a living from cheaper oil, and many have announced recently that they can now break even at $60.

"Even though this is unlikely to be achieved until 2017, there was evidence that progress is being made with sector capex down 21% year-on-year (y/y) and 2016 budgets further reduced by and ," said Barclays analyst Lydia Rainforth. "This is consistent with our US Oil Services team who think that global upstream [exploration] spending could now be down by as much as 20% in 2016 with estimates to take another leg down."

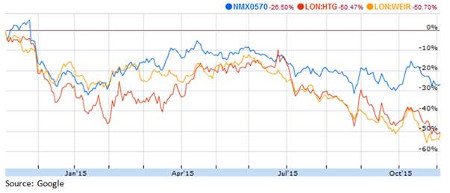

(click to enlarge)

Although slashing capex budgets will support Big Oil dividends and set up the sector for eventual recovery, service companies are struggling. 's third-quarter orders fell 29% on the year, largely due to the drop in activity levels in the oil, gas, power and industrial markets, with original equipment orders down a fifth and demand for spares down a third. With margins diminishing, the fracking pumps firm is making a further £25 million of cost cuts, including the loss of another 400 jobs.

Budgets are shrinking at , too. It's already axed 28% of its workforce to save $50 million a year. Warning that profits are expected to fall by around 90% in 2015, Hunting flagged in a brief trading statement that operating profit has plummeted 85% in the year so far.

Although the balance sheet is strong enough and cash generation above expectations, broker Numis has slashed its earnings per share estimates by 50% for 2015 and expects a loss next year, which could lead to a breach in covenants.

(click to enlarge)

"As the cyclical downturn has deepened through 2015, balance sheets in the oilfield service sector have come increasingly under pressure," says Numis. "We forecast Hunting's net debt:EBITDA to rise from 0.5x in Dec-14 to 5.5x in Jun-16, before falling to 2.8x in Dec-17.

"We believe Hunting's banking syndicate will be supportive of a covenant waiver, particularly given the operational leverage of the business which will enable Hunting's financial leverage to fall relatively quickly once activity begins to improve."

Expecting further volatility, Weir's chief executive Keith Cochrane said: "Looking ahead, we expect trading conditions to remain challenging through the fourth quarter with further declines in upstream oil and gas activity."

But even if the oil price recovers quickly, services companies won’t feel the benefit as the rest of the industry prioritises the balance sheet over spending. Still, Weir is investing in its products and technology to strengthen the long-term potential of its markets and business model, which should position it well for any uptick.

Both Weir and Hunting have underperformed the FTSE 350 Oil Equipment Services sector over the last 12 months (see chart above), falling by over 50%, although both eked out gains on the back of Tuesday's updates. Question marks remain around Weir's valuation, however, and Panmure Gordon recently tipped the shares to fall as low as 875p. Ouch. Hunting, meanwhile, remains one only for the brave given next year could be worse and the potential covenant breach.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.