Warning signals everywhere

9th November 2015 11:14

by Lance Roberts from ii contributor

Share on

Being Patient

Over the last couple of weeks, I have discussed the entrance of the markets into the seasonally strong period of the year and the potential to increase equity exposure in portfolios on a "short-term" basis. To wit:

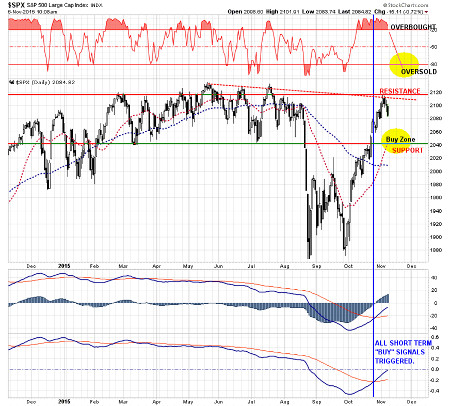

"With the markets EXTREMELY overbought short-term, the setup for putting money into the market currently is not ideal.

"However, as shown in the chart below, the markets have registered a short-term BUY signal that suggests that we remain alert for a pullback that generates a short-term oversold condition without violating any important supports."

The chart below updates that analysis from last week.

(click to enlarge)

As shown, the recent surge in the markets has driven asset prices back to resistance near the old highs. Simultaneously, the markets are pushing into very overbought conditions with a rather extreme deviation from the running moving average.

While that is a lot of "technical mumbo-jumbo", it essentially means the markets have likely gone just about as far as they can currently and need a short-term correction to provide a better "risk/reward" entry for investors to increase equity exposure. As I stated last week:

"Now, with the 'seasonally strong period' upon us, some of that cash can be redeployed during any corrective action that provides a better "risk/reward" entry point. That point is not today."

As shown in the chart above, a correction that pulls the markets back to 2040-2060 without violating the support established earlier this year, will provide a better entry point currently.

While the recent rally can certainly make you "feel" like you have been left behind, that is "emotion" feeding into your investment discipline. Such decision-making processes rarely work out well. Investing, as always, is about discipline and the "patience" to await an opportunistic entry point. That opportunity will present itself, and I will adjust the allocation model accordingly.

However, it is the longer-term picture that I am worried about.

Long-Term Signals Still Bearish

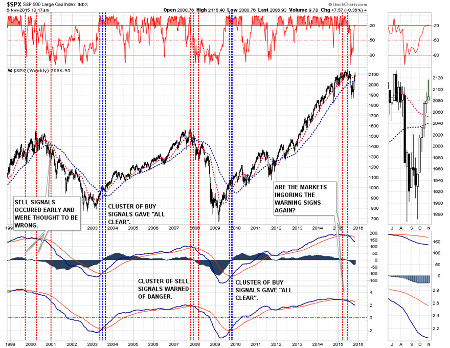

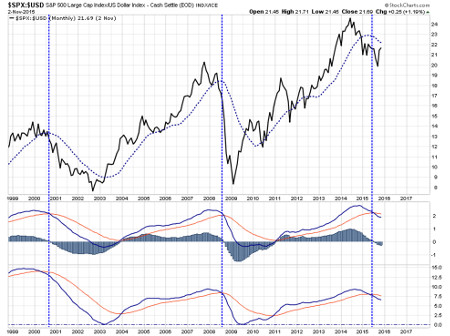

As shown in the chart below, while I am talking about increasing equity risk exposure "opportunistically" over the next couple of weeks for the short-term seasonally strong period, the long-term outlook still remains heavily biased toward risk.

(click to enlarge)

The combined "sell signals," as measured by moving average crossovers, momentum and MACD, have only coincided near major bull-market peaks and bear-market bottoms.

Importantly, those coinciding signals can occur several months before the actual change to the overall "trend" of the market occurs.

Currently, there are two of three longer-term "sell signals" registered with only the final moving average crossover remaining on a "buy" signal. However, unless the markets are able to surge to new "all-time" highs on strong momentum, the third signal will likely be tripped over the next couple of months.

Not unlike previous market topping action, the markets could indeed even register "new highs," as witnessed in both 2000 and 2007 before the major market correction begins. This is typically how "bull markets" end: by providing false signals and sucking in the last of those willing to "buy the top." The devastation comes soon after.

Warning Signs Everywhere

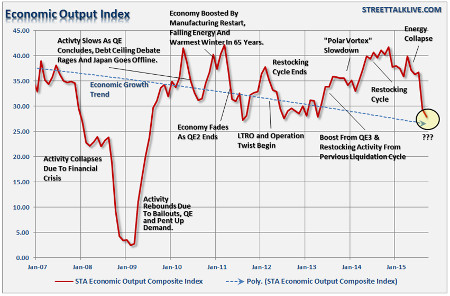

Many have pointed to the recent correction as a repeat of the 2011 "debt ceiling default" crisis. Of course, the real issue in 2011 was the economic impact of the Japanese tsunami/earthquake/meltdown trifecta, combined with the absence of liquidity support following the end of QE-2, which led to a sharp drop in economic activity. While many might suggest that the current environment is similar, there is a marked difference.

The fall/winter of 2011 was fuelled by comments, and actions, of accommodative policies by the Federal Reserve as they instituted "operation twist" and a continuation of the "zero interest rate policy" (ZIRP). Furthermore, the economy was boosted in the third and fourth quarters of 2011 as oil prices fell, Japan manufacturing came back on-line to fill the void of pent-up demand for inventory restocking and the warmest winter in 65-years which gave a boost to consumers' wallets and allowed for higher rates of production.

2015 is a much different picture.

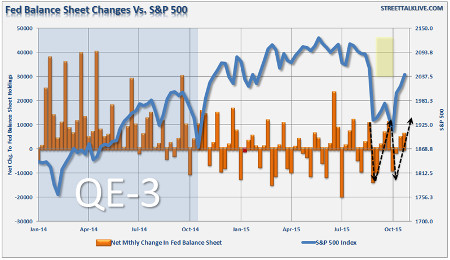

First, while the Federal Reserve is still reinvesting proceeds from the bloated $4 trillion balance sheet, which provides for intermittent pops of liquidity into the financial market, they are now seriously discussing "tightening" monetary policy by the end of the year.

(click to enlarge)

Secondly, despite hopes of a stronger rates of economic growth, it appears that the domestic economy is weakening considerably as the effects of a global deflationary slowdown wash back onto the U.S. economy.

(click to enlarge)

Third, while "services" seems to be holding up despite a slowdown in"manufacturing", the service sector is being obfuscated by sharp increases in "healthcare" spending due to sharply rising costs of healthcare premiums. While the diversion of spending is inflating the services related part of the economy, it is not a representation of a stronger "real" economy that creates jobs and increase wages. (via Zerohedge)

(click to enlarge)

Fourth, the strong US dollar, as compared to other currencies racing for the bottom, is having a negative effect on companies with international exposure. Exports, which make up more than 40% of corporate profits, are sharply impacting results in more than just "energy-related" areas. As I discussed recently, this is not just a "profits recession," it is a "revenue recession" which are two different things.

The chart below shows the S&P 500 as compared to the US Dollar. Since the turn of the century, declines in this ratio below the 18-month moving average, have been coincident with more severe market reversions and economic recessions.

(click to enlarge)

Lastly, it is important to remember that US markets are not an "island." What happens in global financial markets will ultimately impact the U.S. The chart below shows the S&P 500 as compared on a performance basis to the MSCI Emerging Markets and Developed International indices. I have highlighted previous peaks and subsequent bear markets. Currently, the weakness in the international markets is being dismissed by investors, but it most likely should not be.

(click to enlarge)

Lack Of Low Hanging Fruit

While I have suggested that the "seasonally strong" period of the year may present an opportunity for more seasoned and tactical traders, for longer-term investors there is a lack of "low hanging fruit" to harvest currently.

While the recent rally has certainly been encouraging, it has failed materially to change the underlying momentum and relative strength indicators substantially enough to suggest a return to a more structurally sound bull market (valuations notwithstanding).

With price action still confirming relative weakness, and the recent rally primarily focused in the largest capitalisation-based companies, the action remains more reminiscent of a market topping process than the beginning of a new leg of the bull market.

While I am not suggesting that the market is on the precipice of the next "financial crisis", I am suggesting that the current market dynamics are not as stable as they were following the correction in 2011. This is particularly the case given the threat of a "tightening" of monetary policy, combined with significantly weak economic underpinnings.

The challenge for investors over the next several months will be the navigation of the "seasonally strong" period of the year against a backdrop of warning signals.

Importantly, while the "always bullish" media tends to dismiss warning signs as "just being bearish," historically such unheeded warnings have ended badly for individuals.

It is my suspicion that this time will likely not be much different, the challenge will just be knowing when to leave the "party."

I will continue to monitor and update the markets each week for you and adjust allocations accordingly.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.