Sector outlook for 2016

4th December 2015 14:21

by Harriet Mann from interactive investor

Share on

Today's European power markets have been broadly shaped by three crises: OPEC pricing in the 1970s; the acid rain scare of the 1980s; and affordability in the 80s/90s. They forced the hand of European governments to try and achieve what has become a mystical energy triad of low-carbon power production, affordable electricity, and overall security of supply.

As the defensive investors' best friend, utilities are a go-to in times of uncertainty. But with three new theories about to shake up the European market, how far has it really come?

Je ne regrette rien?

Cornered by OPEC's oil price threats, the 1974 Messmer Plan transformed the French power market into one that become so reliant on nuclear power that it represented three-quarters of the region's electricity output by 1990. With one of the largest nuclear plant portfolios in the world, on the face of it France looks like it achieved the allusive triad. But, on closer inspection, broker Investec isn't so sure.

Analyst Harold Hutchinson says: "The Messmer plan did not invent a genie that magically waved away OPEC price risk at zero cost. Hidden cost risks existed, supported, knowingly or unknowingly, by French society (while was fully State controlled), but now also borne by shareholders through the partial privatisation of the company."

With risks of construction, operation and decommission, hidden costs have been passed to the French public and Investec reckons the affordability argument is an illusion. Given the long-life of nuclear assets, the scope for innovation and change is also limited.

Germany

A plot that wouldn't be amiss in a Z-list blockbuster, the threat of acid rain saw Germany harness a number of technologies to offset the effect of burning fossil fuels, instead of phasing them out. European legislation has subsequently put a cap on emissions.

Germany's Energiewende (energy turnaround) also encouraged the 2000 Renewable Energy Act and the Nuclear Law of 2002, the latter of which aimed to phase out nuclear power in 20 years. This was reiterated in 2011 after the Fukushima nuclear accident in Japan.

"These two laws (together with subsequent amendments) have exerted a major influence on German energy policy ever since. In terms of the energy triad, together they amounted to promoting environmental sustainability to the top priority, with other objectives put on the back burner."

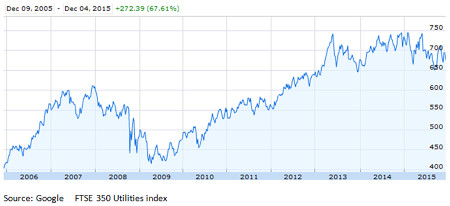

(click to enlarge)

UK

Believing the market was the most appropriate tool to achieve the triad, Secretary of State for Energy Nigel Lawson set the UK on a path of privatisation in the 1980s. When National Grid floated on the London Stock Exchange in 1995, wholesale electricity was traded in a compulsory pool.

This environment was replaced by NETA in 2001, explains Hutchinson, which created the structure we have today built around the "Big Six". Some argue this is the "beginning of the end" of Lawson's liberalisation vision.

The introduction of the 2008 Climate Change Act and 2013 Energy Act has also hijacked the liberalisation agenda. Among a raft of initiatives, the Energy Act launched Contracts for Difference (CfDs) to incentivise generators' investment in low-carbon power.

"UK liberalisation is now in reverse," argues Hutchinson. "Alas, security of supply, environmental sustainability, and affordability have all been compromised in the UK as a result, as power is re-monopolised in the hands of the State."

New ideas

Clearly, Europe is yet to solve the energy triad conundrum, but Investec expects sector dynamics to now be determined by the natural capital theory, stakeholder analysis and distributed energy theories.

Diverging from the ingrained belief that companies are working to enhance shareholder returns, there is a growing movement that believes a company needs to reward all stakeholders, whether they provide equity, debt, or is the workforce.

As well as delivering what many consider a human right, utilities' operations have far-reaching external effects, with the potential for gas leaks presenting a real danger. Utilities are also at the mercy of governments - which can interfere to impact their short-term political cycles - and capital providers, who want to take a short-term investment approach.

"In such a context, a stakeholder approach to the utilities sector, would, we tentatively suggest, have much to recommend it, and indeed…such stakeholder models are gaining ground," says Investec.

"Often they are associated with a mixed-ownership state/private sector model."

Another theory gaining traction is Dieter Helm's Natural Capital approach to ensure sustainability of economies. The University of Oxford professor and chair of the UK's Natural Capital Committee argues that all valuable natural elements are either "renewable" or "non-renewable". By approaching infrastructural environmental sustainability, utility companies can benefit all stakeholders.

This approach is already being used in the water sector, but the power sector needs to take heed. "The future utility needs to be seen to be at the heart of environmental sustainability, not the 'devil' in the pack," warns Hutchinson.

The final conjecture directing utilities' future is distributed energy, which argues that power density dictates future distribution. Investec reckons we are on the cusp of an interesting transformation in electricity systems, turning away from high power density technologies supplying electricity to lower power density demand centres.

"Renewable based systems are attempting to replace this with low power density supply technologies to rising power density demand, especially given the projected increase in mega-cities in the future," said the analyst, although he admits he sees a future with both working in tandem.

What does it mean?

This is all very interesting, but how does it impact the average investor?

As the utility sector has sold its upstream oil and gas businesses over the last three years, returns are normalising and capital has been either directly destroyed or redeployed, says Hutchinson. But the theories explained above present their own challenges to the sector, namely surrounding governance, catching up with the now-mainstream renewable movement, and ability for the traditional utility companies to adopt mixed power solutions.

"While recent years have been difficult for the EU utilities, we believe that returns are now bottoming as witnessed by, for example, the sector trend in return on equity," Hutchinson concludes.

"While it is too early to be bullish, we suspect the EU utilities are finally starting to adapt to the challenges facing them. We believe the more dynamic utilities may now be close to a period where returns can start to recover."

The analyst is bullish on (price target 260p), (325p), and (250p), which represents upside of 22%, 39% and 19% respectively.

'Hold' ratings have been reserved for (860p) and (840p), which is 5% below and flat on respective current prices, while (2,100p) and (1,500p) also have 'hold' recommendations.

is the only UK-listed 'sell', with its 870p target price representing 9% downside.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.