How AIM smashed blue chips in 2015

31st December 2015 09:20

by Andrew Hore from interactive investor

Share on

It has been a good year for AIM in performance terms. The junior market has risen, whereas the larger Main Market comparators have declined in value.

The FTSE AIM All-Share index is up 5% over the year, which is much better than the most-viewed Main Market indexes. The index has fallen by around 6% in the same period, and the index did only slightly better than that, down 4%.

And the larger AIM companies did much better than the junior market as a whole, with the FTSE AIM 50 surging by nearly one-fifth in 2015 and the FTSE AIM 100 by 14%, a similar to the rise in the FTSE Fledgling index. Nearly three-quarters of the companies in the AIM 50 increased in price over the year, while , by far the largest company in the index, rose by one-quarter, which clearly aided the outperformance.

One of the stars, and the highest riser in the AIM 50, is spirit mixer drinks supplier - up 230% - which has been on AIM for just over one year. Lloyds Development Capital has offloaded all of its stake, but willing buyers have been found despite the heady price - the prospective 2016 valuation multiple is more than 40 times. Fevertree will have to continue to grow strongly or it will not be able to sustain this share price.

Even though Quindell, now known as , has had its ups and downs the share price had still almost tripled prior to the distribution of cash to shareholders following the sale of the legal operations to Slater & Gordon. That makes it one of the best performers on AIM during the year and the second best performer in the AIM 50. To put this into perspective, Watchstone has fallen by nearly two-thirds over a two-year period.

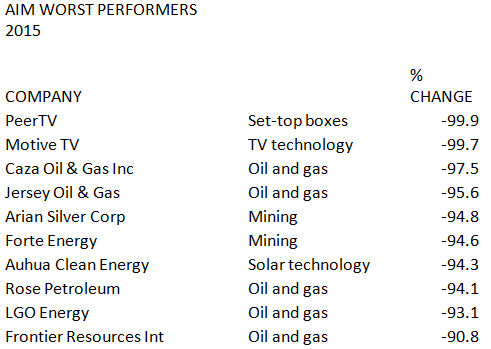

The worst AIM performers are all more than 90% lower over the year. It is noticeable that all of them are down by similar percentages over two and five-year periods - if they have been around that long.

Unsurprisingly, the poorer performers on AIM are dominated by resources companies, although set-top box technology firm and TV delivery technology developer are worst of all. Both these firms are short of money and have undertaken share consolidations, where their share price has fallen back to their pre-consolidation level.

Seven out of the ten worst performers are resources companies including , which has just raised additional cash, , and .

There are companies not on the list because they have gone bust or left AIM. The most high-profile recent example of this is Greece-based mobile technology company Globo, which went into administration after fraudulent accounting was uncovered.

Solar technology firm may be one of the worst performers in the list, but it is also one of the apparent minority of Chinese firms that were quoted at the beginning of the year that are still on AIM.

Trading in the shares of sportswear manufacturer Naibu was suspended and ultimately cancelled after executive chairman Lin Huoyan failed to provide information about the state of the business. It turns out that the manufacturing site has been closed down and the chairman remains difficult to get hold of. The company's non-executive directors have found it difficult to take control of the Chinese subsidiary and its assets but they continue to try to do this.

Other Chinese companies have had their quotations cancelled because their nominated adviser has resigned because of disagreements over corporate governance.

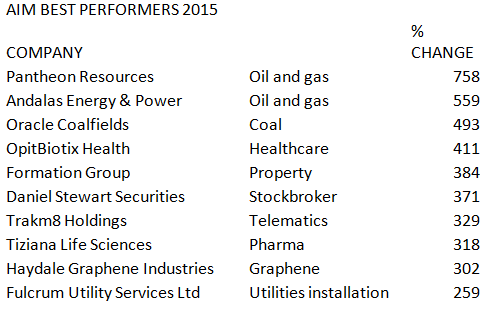

Despite the falling commodity prices there have been strong performers in the oil and mining sectors, and the three best performers on AIM in 2015 are resources-focused companies: , , formerly CEB Resources, and .

The Pantheon Resources share price is nearly nine times the level it was one year ago. The main rise in the share price was in the past three months and it was triggered by good test results from the VOBM#1 exploration well in Polk County, East Texas. The second well in the drilling programme is VOS#1 in Tyler County, East Texas and the initial news has been positive, although flow test results are still to be published. Pantheon's management is experienced in the region and knows where to look for oil. One of the key things about Pantheon's potential production assets is that they should be economic at oil prices lower than $30/barrel.

Andalas changed its name to reflect its new focus on oil and gas in Sumatra, Indonesia. The shares have been suspended since October and the company has until 22 April to publish a prospectus for an acquisition, so it may not return.

Oracle Coalfields has been developing a coal project in Pakistan for a number of years, but in 2015 it made major progress towards its realisation. The project is in the Thar Desert in the south east of Sindh Province and the Pakistan government is keen to increase electricity supply. The plan is to build a 4 metric tonnes (Mt) per annum mine and a 600 megawatt (MW) power station.

The best-performing non-resources company is , which is developing treatments for high cholesterol, obesity, diabetes and other ailments using technology based on the human biome. Positive human trials for a cholesterol reducing capsule product and progress with other treatments has attracted the attention of investors. OptiBiotix has a low cost base and has signed up a number of partners to help it develop commercial products.

Weathering the problems of the global financial crisis

has been on AIM for nearly 15 years and the share price has had its ups and downs. The company started as a sports agency and marketing business and then moved into property development. Formation managed to weather the problems of the global financial crisis and the current focus is residential property development. The share price is still barely one-fifth the level it was in 2001. However, a pre-tax profit of £1.75 million is anticipated for the year to August 2015 - due to be published in January - and the profit is expected to more than double this year.

The strangest company on the list is broker , particularly as it has lost its nominated adviser and looks unlikely to retain its quotation. Daniel Stewart has consistently lost money for a number of years and it remains short of cash. Share buying by former Quindell boss Rob Terry's Quob Park pushed up the share price and the performance certainly has nothing to do with any significant improvement in results.

Telematics hardware and services provider has made amazing progress this year, including extending its relationship with the and adding extra services through the acquisition of the DCS automotive camera systems business. The year is ending with the proposed £9.1 million cash and shares acquisition of Route Monkey, which provides software for scheduling, modelling and optimising the utilisation of vehicle fleets. The deal adds expertise in electric vehicle charging.

is developing targeted cancer and immunology drugs. Tiziana reversed into a shell in 2014, but the share price took off in 2015. The drugs in development are focused on unmet medical needs or provide personalised treatment. They include anti-cancer stem cell technology licensed from the University of Cardiff.

Graphene and nano materials developer has bounced back strongly after a horrendous first year on AIM when its share price slumped. The acquisition of EPL Composite Solutions provided Haydale with a revenue generating business. The share price has still not reached the original placing price of 210p, although nearly £6 million was recently raised at 160p a share.

Gas and electricity infrastructure services provider Fulcrum Utility Services Ltd had been consistently losing money, but a new management team has turned around its fortunes and moved it into profit in the year to March 2015. Sharp reductions in costs have helped to improve margins and profit, as did bringing services in house and shunning low margin work. House broker Cenkos forecasts a sharp rise in 2015-16 profit from £1.2 million to £3.3 million - a figure it had previously been predicting for 2016-17.

*all data as at 18 December 2015

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.