Our AIM tips for 2015 rocket 84%!

30th December 2015 09:30

by Andrew Hore from interactive investor

Share on

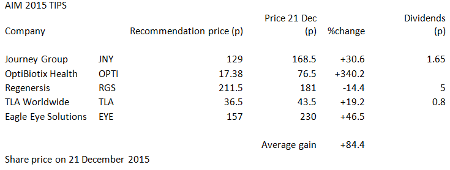

Choosing one of the best AIM performers of 2015 last January in my AIM tips of the year has ensured a strong performance from the portfolio of five companies.

Three of the other four have also done well and they have outperformed both the FTSE AIM All Share index and the FTSE AIM 50 index. The one that has declined will hopefully claw those losses back this year.

The average gain was just over 84% and if dividends are included it is above 85%.

OptiBiotix Health

Original recommendation: 17.38p

Share price: 76.5p

Human microbiome-based treatments developer is one of the top five performers on AIM during 2015. OptiBiotix has made impressive progress during the year and it has completed human studies for a cholesterol reducing product as well as starting pilot manufacturing studies. The most recent development deal is with Italy-based Centro Sperimentale del Latte, which intends to synthesise and purify novel sugars from microbial strains. The partner will provide the development funding.

OptiBiotix is not short of cash, though, and the cash outflow in the six months to May 2015 was less than £500,000. It has taken advantage of the sharp rise in the share price to raise £1.5 million at 75p a share. This cash will finance the expansion of in-house product development and extend the OptiScreen technology platform into additional areas, including diabetes, bone health, skin care and wound care. There are also plans for a new technology platform called SweetBiotix, which will be used to develop healthy sugars.

Pro forma cash is £3.7 million and even after taking on four additional scientists the cash outflow is relatively modest considering the progress made. OptiBiotix has been trading for fewer than four years and it has built up a family of patents. A multinational consumer goods company is interested in the food supplement capsule for cholesterol reduction and there should be news next year about whether it wants to take up its option to move ahead with a commercial product. There are also potential over the counter products that may be developed with AIM-quoted Venture Life.

Although OptiBiotix has been one of the best performers on AIM it is still a modestly sized company given the potential. News about the launch of commercial products is likely to provide a further boost for the share price.

Journey

Original recommendation: 129p

Share price: 168.5p

Dividends paid: 1.65p

has won its first airline catering contract outside of Los Angeles during the year although the benefits of this contract will not show through for some time. Journey has proved the concept in Los Angeles and there is no reason it could not be rolled out in the US and overseas. The share price is even starting to reflect the progress that has been made.

The Los Angeles-based Air Fayre subsidiary does not operate its own food premises and does not cook food. Using restaurant premises helps to cut capital investment and make the service more competitive. The newest contract is at Memphis International Airport, which will be a new hub for the business, and additional work has been won at Los Angeles.

Share buy backs have helped to return cash to shareholders and provide a floor to the share price. The Fourvision Fund slashed its stake to below 3% and it appears that this was part of the most recent share buy back. Journey has gained shareholder approval to buy back an additional 689,932 shares, which is 5% of the share capital, including shares held in treasury. The shares are trading on 15 times 2015 prospective earnings, falling to 12 in 2016.

Journey has strong backing from institutional backers including JO Hambro and Kestrel Partners. The share price has fallen back from its 12 month high of 183.5p and the potential for growth remains enormous.

Eagle Eye Solutions

Original recommendation: 157p

Share price: 230p

The rollout of a major contract did not go as quickly as hoped, but digital coupons and promotions technology provider success in winning new business means that the long-term outlook is extremely good. Asda and have signed up to Eagle Eye's AIR platform, which covers campaign creation, issuance, redemption and reporting. Real-time offers can be made to customers via SMS messaging and email. New modules are being added to the AIR platform.

In the year to June 2015, revenues grew 165% to £4.9 million, but there was a £1.78 million cash outflow from operations. There was £4.29 million in the bank at the end of June, but this has fallen to £2.9 million at the end of the first quarter.

Revenues should continue to grow rapidly with subscription and transaction fees accounting for 83% of first quarter revenues. More than 5.3 million vouchers were redeemed via the company's AIR platform in the first quarter, a 36% year-on-year increase. New projects have been launched for The Restaurant Group and .

Eagle Eye will continue to lose money this year, with the potential to make a modest profit in the year to June 2017. The share price has held up even though the chief executive and chief technology officer sold shares at 235p during September. The shares appear fully valued for the time being, but more contract news could push them higher.

TLA Worldwide

Original recommendation: 36.5p

Share price: 43.5p

Dividend paid: 0.8p

Sports representation and marketing firm is on course for a good set of results for 2015, but the share price has drifted back since the beginning of October. The issuing of deferred consideration and management incentive shares may have knocked the share price. The recent move in the exchange rate to below $1.50/£ will at least make the earnings higher in pence per share terms.

In the first half of 2015, revenues were 56% higher at $15.6 million and, stripping out the Australian acquisition, the organic growth was 13%. The underlying profit improved from $3.5 million to $3.99 million. The profit was held back by investment in new projects, such as the International Champions Cup football tournament held in Australia during July. The original baseball business is also growing.

House broker Numis expects a jump in full year profit from $8.6 million to $12.7 million and an improvement in the dividend from 1.28 cents a share to 1.58 cents a share is forecast, providing a yield of more than 2%. The 2016 profit forecast is $14.1 million. The shares are trading on less than ten times 2015 earnings, falling to nine in 2016.

Events such as the International Champions Cup football tournament, where Tottenham and Juventus have been signed up for 2016, take money to set up and the real benefits start to be reaped after two or three years. The shares remain attractive.

Regenersis

Original recommendation: 211.5p

Share price: 181p

Dividends paid: 5p

has been the laggard of the five companies and even the 5p a share dividend only makes a small dent in the loss over the year. During the autumn, Regenersis announced that it intended to sell its depot services operations and concentrate on its higher margin data erasure business, which has much greater growth prospects. This could help the share price to recover but there has been a lack of news since then.

The acquisition of US data erasure business Tabernus in September made Regenersis' Blancco business number one in the US as well as further enhancing its world number one status in data erasure. The enlarged division could make a 2015-16 operating profit of £7 million, although there will be central costs to subtract from that, on revenues of £21.5 million. Tabernus was acquired for $12 million - four times its annual revenues. On that basis, the whole division could be worth £80 million plus and, given that it is seven times the size of its nearest competitor, possibly more than that.

Once the non-core businesses are sold there should be a distribution to shareholders of part of the proceeds with the rest used to grow the remaining business. The non-core assets should be worth more than 50% of the current market value. However, there is no deal yet. There is likely to be continued uncertainty and volatility in the share price until it is clear how much can be raised and what the remaining business will look like as an independent entity. Hold on.

(Click to enlarge)

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.