Game over for Oxus Gold

23rd December 2015 12:31

by Lee Wild from interactive investor

Share on

chairman Richard Shead is "devastated" after losing a long-running legal battle with the government of Uzbekistan. Long-suffering shareholders will be, too, and trading in the gold miner's shares has now been suspended on AIM pending clarification of its future financial position.

"As a result of the decision of the tribunal, a material uncertainty exists in relation to the company's ability to continue as a going concern and, therefore, to realise its assets and discharge its liabilities in the normal course of business," admitted the company Wednesday.

Shead, who said in September that he "remained confident" that the tribunal would find in its favour and award "fair compensation", has promised to extract "as much value as possible for shareholders", but the outlook is pretty grim.

Oxus had agreed to sell its 50% stake in the Amantaytau Goldfields joint venture (AGF) - sat next to the world's largest open pit gold mine - to the Uzbeks at the beginning of 2011, but no reply was ever received. Instead, the Uzbek's made it impossible for Oxus to function at Amantaytau. Oxus had already lost the Khandiza zinc/copper/lead/silver deposit in 2006.

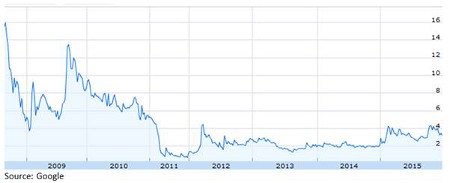

(Click to enlarge)

It began fighting the "expropriation" of its stakes in the two assets in August 2011. Now, we hear that the United Nations arbitral tribunal on Monday "dismissed entirely" the company's investments in Khandiza, and for AGF, too, except for a breach of "fair and equitable treatment" standard which will result in damages to Oxus of $10.3 million plus interest.

But the tribunal ordered each party to bear its own costs, and to each pay half of the tribunal's fees and expenses.

Oxus said in September that it had received $6.15 million from a litigation funder, repayable only upon the successful outcome of the arbitration. "The final award obtained by the company has to be considered together with the outstanding claims of the third-party litigation funder on this amount and the company's other outstanding liabilities," said Oxus.

Bosses are currently discussing whether to appeal through the French courts, but crunch talks with its litigation funder and other creditors will likely determine the final decision here.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.