Lloyds Banking divides opinion in City

25th January 2016 15:05

by Lee Wild from interactive investor

Share on

European Banks had a terrible 2015. The first three weeks of 2016 have been awful, too, and the sector now trades at all-time relative lows. Despite believing most lenders will continue to struggle this year as negative fundamental trends play out, one analyst has picked half-a-dozen winners it thinks could generate average upside of 30%-plus.

"Following weak revenue performance from the banks in third-quarter 2015 and a reappraisal of the returns on equity that banks can make, the sector underperformed by 11% over the last five months of the year," explains James Chappell, banks analyst at Berenberg and once voted one of the Wall Street Journal's "Best on the Street".

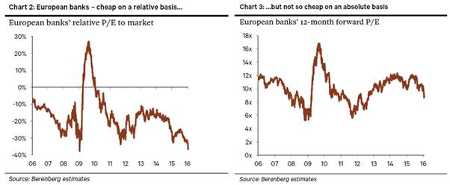

"The banks are now trading at a 36% discount to the market on relative price/earnings (PE) ratio, which is a 10-year low. On a relative price/book value (P/BV) basis, the banks do not look quite as cheap, but do trade at a 57% discount. In absolute terms, the sector is trading at 0.85 tangible book value (TBV) and 8.8x 2016 earnings, a 15% discount to 10-year averages."

(Click to enlarge)

Chappell attributes much of the underperformance to six major trends:

It highlights a surge in global debt close to 300% of GDP, but with bank profits hit by a rise in lower-margin public-sector debt and drop in higher-margin private-sector borrowing.

Banks are also suffering margin pressure as it's harder to reprice deposits now, with asset spreads in decline. Longer maturity of loan books in Northern Europe means they should do better than those in the south. There's a real risk that homeowners could struggle to repay mortgages, too.

Exposure to the oil and commodities industry remains a concern, particularly among the French banks, and Chappell also expects credit quality to deteriorate in emerging markets during 2016. And these two sectors are also tipped to lead a turn in the credit cycle - rising credit costs and weak revenue will drive further downgrades and lower earnings per share (EPS) in 2016 than the year before.

Berenberg's basket of winners

, , , , and make the list of six long-term winners. And HSBC looks "increasingly attractive" having just revisited a four-year low, offering upside of 30% to its price target of 750p, plus a dividend yield more than 6%. "We see this as sustainable considering their risk management and capital positions," writes Chappell.

And it is the risk focus of management which keeps HSBC among the top picks, the only UK-based bank to make it. "We believe the market has misunderstood the repositioning of the balance sheet that was undertaken by management over the past four years," says Chappell. "We therefore do not expect provisions to rise as much as the market seems to fear.

"This should allow sustained capital return to continue (current dividend yield is 7.5%) and with the shares trading below TBV [currently at a 20% discount] we believe HSBC offers 'bond-like' returns."

However, bosses must demonstrate clear control of costs in 2016, otherwise they may find themselves looking for alternative employment.

(Click to enlarge)

Both ('hold', price target [PT] 200p) and ('sell', PT 250p) make it onto Berenberg's list of "wild cards".

"Barclays has a core business to fall back on that clearly has value, namely its UK retail/corporate business and Barclaycard. The lack of recent capital build, however, leaves it vulnerable to the ever-rising bar of UK stress tests and potentially without enough capital to change. The new CEO, Jes Staley, presents his strategy on 1 March."

Chappell continues to argue that the way to unlock shareholder value at Barclays is to break up the bank. And that is looking increasingly likely as regulators introduce ring-fencing in the UK, comprehensive capital analysis and review are brought in in the US and as living wills come into place.

RBS gets the nod as Chappell believes that 2016 could be the year the lender gets past the worst in terms of issues to resolve. The corporate and institutional business has a strategy in place to shrink the balance sheet, too.

Mixed views on Lloyds

, on the other hand, is the "extreme opposite", where operational improvements have run their course. "It is hard to see how management keeps not only margins flat, but also revenues considering competition and the outlook for interest rates," says Chappell. "Provision write-backs have also helped to push impairments below market expectations."

He expects capital return to disappoint, with full-year results for 2015 forecast to deliver a dividend per share of 1.5p versus consensus of 2.4p. That's because regulators continue to demand higher capital levels than Lloyds' current 13.7% common equity Tier I (CET1) capital ratio.

"Trading on 1.2x TBV, we continue to expect it to de-rate to 1x." Chappell says 'sell' with 55p price target.

But the team at JP Morgan (JPM) thinks differently. The price target for Lloyds is cut from 98p to 90p, but the shares are still rated 'overweight' despite revenue pressure from a lower for longer UK rate environment.

It does mean EPS forecasts receive a haircut (only a trim), although dividend estimates are unchanged. JPM still predicts a dividend yield of 4.1% for 2015, 6.4% for this year and 8.2% in 2017.

When Lloyds publishes full-year results on 25 February, JPM expects to see a 2p dividend, including the 0.5p special, and adjusted EPS of 8.2p. That puts the shares on a PE ratio of just 8 times.

"We believe that Lloyds is best positioned within the sector to complete its balance sheet transformation and become a dividend growth story," says the broker. "We view any pull back as a buying opportunity. Lloyds remains our top UK bank pick."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.