Who's made Lloyds and RBS their top picks?

26th January 2016 17:28

by Lee Wild from interactive investor

Share on

Banks have had a stinker so far in 2016. The FTSE 350 banks index is down almost 13%, more than double the deficit for the . We reported yesterday how the sector was trading at all-time relative lows, and that it is dividing opinion in the City. Now, one analyst has re-launched coverage of the five large UK banks.

Price targets and earnings per share (EPS) estimates are cut for all five, and broker UBS admits that results season for full-year 2015 will include "sombre" trading updates. However, it remains positive on all but .

"In and , our preferred names, we see attractive businesses (less investment banks), lower regulatory risk, and 46-58% of market cap returned by dividend or buyback by end-2020E," explains analyst Jason Napier.

"We think these attractions are significantly undervalued and see 35-39% one-year total shareholder return."

Lloyds is still a "top pick and a key call", although, as with JP Morgan yesterday, the price target is cut, this time from 97p to 88p.

Of course, there are concerns about Lloyds' margin, with net interest margin tipped to be flat quarter-on-quarter in the final three months of 2015. But UBS thinks it is better positioned than peers, and believes the lender has £1 billion of cost-cutting potential as it shrinks the branch network.

UBS also factors in £6.7 billion of charges for conduct costs, but reckons this is probably over-cooking it. And it will bring the bank to a largely de-risked state.

There's a valuation argument, too. Lloyds trades on about 8.7 times EPS estimates for 2017 and offers a 6% ordinary yield with special dividends or share buybacks on top.

"We expect a full government exit in first-half 2016 and dividends and buybacks to return more than 40% of market cap by end 2020," says Napier.

"We set our target price by sum-of-the-parts, applying fair price/earnings (PE) multiples to 2017 divisional profit estimates. At 88p, we see 32% capital upside with an attractive yield thereafter. We think the stock is undervalued."

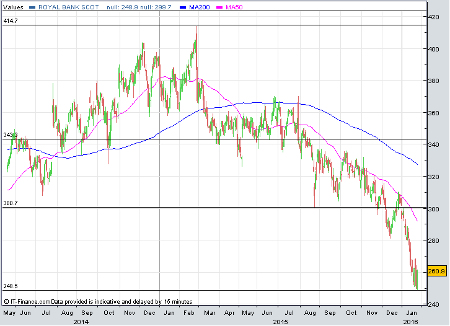

Time to buy RBS

He also thinks it's "time to buy RBS", which is described as "much too cheap".

"Until now, the bank's small index weight (0.6% of the ), large overhang (500 days of volume) and legacy issues have given investors sufficient excuse to avoid the share. But, the recent sell-off has seen RBS fall too far, in our opinion, leaving it a lower risk and more attractive return prospect than the market appreciates."

Napier thinks RBS had 69p per share of surplus capital at the third quarter results - 25% of market cap - and that's expected to rise further. "We think a legacy-free RBS should trade in line with Lloyds Banking Group at 1.3x tangible net asset value, as uncertainty begins to clear."

On that basis, the shares are worth 350p.

Elsewhere, is rated a 'buy' with price target of 520p. With a meeting to decide the future of its global headquarters imminent, UBS cuts EPS estimates by 7-9% for 2016-2019 and pencils in flat dividends for the "foreseeable future".

"But we think the dividend is considered sacrosanct and that current management will deliver such a payout even if costs disappoint," writes Napier. "The 7% yield is real, we think."

The argument for is less convincing, and UBS cuts estimates by a quarter. "We think that the market is too optimistic on investment banking revenues, and that the approaching reality of higher funding costs in a UK ring-fence and US holding company environment will prompt a new plan in 2016."

However, despite cutting its target down from 302p to 215p, UBS still says 'buy', as the share price plunge looks overdone.

Finally, is rated 'neutral' with 510p target. "With more than half of group capital allocated to less attractive risk/reward activities, we expect the transition process - made harder by weak markets - to lead to weak income and loan-loss trends. We forecast a $1.2 billion (£0.8 billion) loss for 2016," warns Napier.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.