Insider - Three chiefs make maiden purchases

5th February 2016 14:07

by Lee Wild from interactive investor

Share on

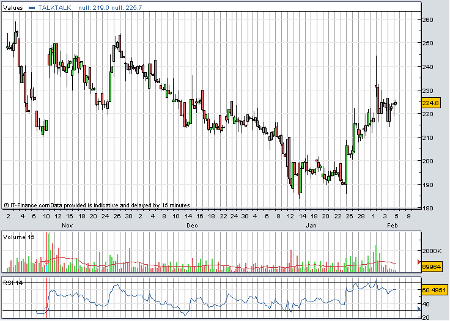

Buy! Buy! TalkTalk

Last year's very public cyber-attack inflicted heavy damage on share price, although a recovery, which began just last week, looks promising.

In a third-quarter update, chief executive Dido Harding told us the company lost 101,000 customers over the three-months, an estimated 95,000 as a direct result of the attack. It wiped about three percentage points off revenue for the period, too, although the top line did grow by 1.8%.

Harding puts the trading impact of the attack at £15 million and estimates the hit from entering the final quarter with far fewer customers at £20 million. Beefing up online security and offering free upgrades will also cost £40-£45 million.

It's why cash profit is expected to come in at £255-£265 million in the year to March compared with the £290-£300 million pencilled in last year.

Encouragingly, so-called revenue-generating units, which fell by 70,000 in the quarter, returned to growth in January. And management is confident enough to provide profit forecasts for 2017. Look for £320-£360 million and a dividend "no lower" than this year.

Conservative peer Harding has already backed the rebound with her own money, spending £100,000 on 40,966 TalkTalk shares at 244p each in November.

Now, just hours after the results, managing director at TalkTalk Business Charles Bligh opened his account. He's bought 617,978 shares at 240.92p each, worth almost £1.5 million.

Barclays thinks the IT expert has done the sensible thing. The broker still rates the shares 'overweight' and believes they're worth 350p, given an "ability to extract costs out of the business, to drive higher margins and hence cash flow".

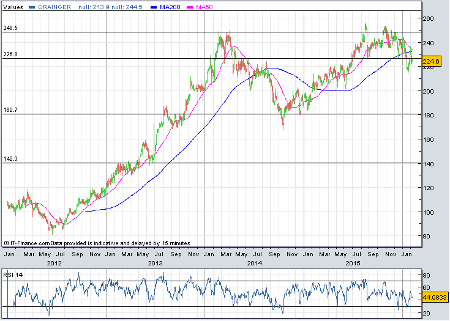

Building confidence at Grainger

Helen Gordon was chosen to run the UK's largest listed residential property owner and manager in June last year. She joined in November and took over officially only recently. Yet, she's already released a strategy update, backed up by a £125,000 bet on it succeeding.

There'll be action around three key themes - accelerating the acquisition of rental homes, spending more on developing private rented sector (PRS) stock, and improving conversion of PRS opportunities. An operational review will report back at the half-year results in May.

But a week ahead of first-quarter numbers (11 February), Gordon made her maiden share purchase, buying 53,786 at 232.4p. Andrew Carr-Locke, a non-executive director since last year, also made a debut purchase, snapping up 10,000 shares at 232.1p.

Numis Securities analyst Chris Millington likes Grainger. "Despite the renewed momentum in the business and more strategic clarity, the shares are trading at a 20% discount to September 2017 triple net asset value, which compares to the long run discount of 11% (if 2008 and 2009 are excluded).

"We do not think this captures the potential for a more stable business which should be able to increase shareholder distributions over time." He says the shares are worth 287p.

Lakehouse

And, finally, to . The company, involved in regeneration and construction of homes, schools, and public and commercial buildings, had just issued a profits warning, but our in-house stockpicker Edmond Jackson thought he'd spotted a potential turnaround play.

"Though not yet a firm 'buy', disciplined investors will watch to see what extent of insider buying may evolve," said Edmond.

Well, "disciplined investors" will have noticed directors piling into the shares just days after a 63% slump from 87p to just 32p, sparking a rally of as much as 20% Friday to 42p.

In what looks like a three-line whip, chairman Stuart Black, chief executive Sean Birrane, finance director Jeremy Simpson and executive director Michael McMahon each bought 71,430 Lakehouse shares at 35p. The total spend was over £100,000.

Between them, the four now own over 18.6 million shares, worth about £7.3 million - still considerably less than at IPO. Lakehouse shares floated at 89p.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.