Ten contrarian shares to buy

17th February 2016 13:37

by Ben Hobson from Stockopedia

Share on

Buying shares that nobody else likes is a strategy that can test the nerve of even hardened value investors. Regardless of how attractively valued those shares are, or whether their underlying quality gives comfort that they'll rebound in price, being a contrarian is never easy. But in falling markets like we've seen this year, it's a potentially useful strategy for finding stocks that might have momentarily slipped into bargain territory.

From a peak last April, the value of the index has fallen by 15%. While this isn't technically a bear market, the long, slow decline has been painful for investors to watch. When markets are in correction mode, confidence can evaporate on the slightest inkling of bad news.

It's often in moments like these that stocks with racy valuations and less-than-solid financial quality can see their valuations plummet. But, in the confusion, it's equally possible that the tide of fear takes with it some otherwise robust shares.

Hunting for quality at cheap prices

One of the most famous investors to recognise the psychological dynamics - and investing opportunities - of manias, panics and volatility is David Dreman. We've met Dreman before in this column. He's a Canadian-born value investor who cut his investment teeth on Wall Street during the 1960s. At the time, stocks were soaring as investors piled in to push valuations skyward. It ended badly, of course.

Dreman showed that the cheapest fifth of the market (by PE) outperformed the dearest fifth by 6.7% annuallyDreman reconfigured his investment approach by creating contrarian strategies that would play on the psychological flaws of others. He went in search of shares that nobody liked, particularly the highly influential company analysts who were widely followed and often wildly wrong in their forecasts.

To do this, Dreman employed some very simple rules. He applied a basic value rule of selecting the cheapest 40% of the market by price-to-earnings (PE) ratio and then sifted the results for quality according to company size, financial strength and growth.

But he didn't just use the PE - he developed three other contrarian strategies which, between them, use the price-to-book (PB) and price-to-cashflow ratios and high dividends. Dreman's studies showed that the cheapest 20% of the market by PE outperformed the most expensive 20% by 6.7% annually.

Screening the market

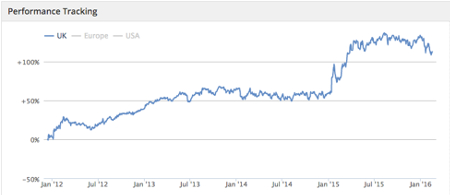

Stockopedia's tracking of the Dreman low-PE strategy in the UK has seen a 20.7% return over the past 12 months - not bad against the backdrop of a falling FTSE All-Share.

It's an approach that needs careful analysis and adequate diversificationIf you look at some of the companies currently meeting the strategy rules, there are some notable names. Among them are housebuilders like , and . There are also big financial firms, which have been particularly buffeted in the recent volatility, such as and .

Likewise, the screen has picked up retailers, including and , which have issued disappointing results over the past year, and have been punished by investors as a result.

| Name | Market Cap £m | PE Ratio | Return on Equity % | EPS Growth % | Yield % |

|---|---|---|---|---|---|

| Man | 2,663 | 8.39 | 17.9 | 18.6 | 5.1 |

| Bonmarche Holdings | 89.3 | 9.13 | 42.8 | 23.3 | 3.9 |

| Tullett Prebon | 799 | 9.75 | 24.7 | 4.3 | 5.1 |

| Bovis Homes | 1,168 | 10.7 | 12.7 | 4.22 | 4.2 |

| Epwin | 171.6 | 11.2 | 33.6 | 12.8 | 4.1 |

| Bellway | 3,132 | 11.3 | 19.2 | 44.7 | 3 |

| Bloomsbury Publishing | 113.9 | 11.8 | 7.13 | 20.1 | 4.1 |

| ICAP | 2,637 | 11.9 | 14.5 | 12.9 | 5.4 |

| Galliford Try | 1,131 | 11.9 | 16.7 | 23.5 | 5 |

| Shoe Zone | 101.8 | 12 | 23.6 | 5.83 | 4.8 |

Value investors naturally take a contrarian approach to the market, looking for out of favour stocks that might have hit temporary setbacks. Of course, in a down market where there is widespread pressure on valuations, there is a greater risk than normal that the prices of these shares may fall further before rebounding (if they do).

So it's an approach that needs careful analysis and, like all value strategies, adequate diversification. But this combination of attractive valuation and high quality could be a useful starting point in considering where and when to buy back into the market.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ben Hobson ofStockopedia.com, the rules-based stockmarket investing website. You canclick here to read Richard Beddard's review of Stockopedia.com and learn more about the site.

● Interactive Investor readers can enjoy a completely FREE 5-day trial of Stockopedia by clicking here.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

Ben Hobson is Investment Strategies Editor at Stockopedia.com. His background is in business analysis and journalism. Ben researches and writes regularly on investment strategy performance and screening ideas for Stockopedia.com. He is the author of several ebooks including "How to Make Money in Value Stocks" and "The Smart Money Playbook"

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.