Best shares to play Brexit theme

22nd February 2016 13:29

by Harriet Mann from interactive investor

Share on

With the date for the UK's European Union (EU) referendum set for 23 June, much of the cabinet is campaigning to stay in the EU. But high profile rebellions, most recently from London Mayor and Prime Ministerial hopeful Boris Johnson, have now thrown the race wide open. Investors have never been a fan of uncertainty, so Panmure Gordon has pulled together the stocks it thinks can play the volatility.

Although nearly a third of FTSE 100 bosses believe Britain is better off in the EU, London equities are so far brushing off the threat. The blue-chip index leapt over 1% higher Monday, reaching an intraday high of 6,035.

"The possibility of a much closer Brexit campaign, which could genuinely go either way, has seen sterling fall, as investors try to work out what this possible 'leap into the unknown' might mean for individual companies and the wider UK equity and bond markets," writes Interactive Investor's head of investment Rebecca O'Keeffe.

Nearly 14% of the revenue from the UK's 300 largest companies comes from the rest of the EU"With the FTSE 100 being so globally oriented, with a significant majority of profits stemming from overseas earnings, the focus of the equity market's attention may turn to smaller, UK focused companies which are at the sharp end of the debate, as well as the banking sector."

Broker Panmure Gordon reckons growing referendum uncertainty will sink further into investor appetite, expecting the correlation between UK equities and their global peers to break, a rare occurrence. In fact, the cross-correlation has only dropped below 0.5 four times since the turn of the century: in the dot-com burst of 2000, the Foot and Mouth crisis of 2001, the London terrorist attacks in 2005 and the Scottish independence referendum of 2014.

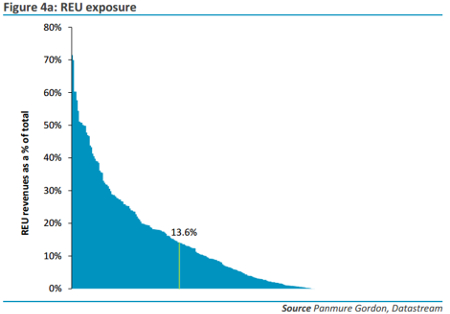

A vote to leave will certainly provide some problems for the UK, including additional trade barriers between UK and the rest of the EU (REU). Nearly 14% of the revenue from the UK's 300 largest companies comes from REU. While ten of these generate over half of their sales from outside the UK, around a third of these companies do not rely on the REU for any of their revenue. So, the picture is mixed.

Panmure doesn't reckon the UK is in a very revolutionary mood, especially given recent economic strengthPublic pressure could also force an independent UK to restrict access for economic migrants, which will constrain the supply-side growth that has contributed 5% to UK GDP since 2004, argues Panmure Gordon. Although it won't all be doom and gloom, the different experiences of Norway, Switzerland and Iceland suggest there is not a "one size fits all" approach.

"Therefore, at the margin, we view that the impact of a vote to leave the EU will dampen UK economic activity," says Panmure Gordon's chief economist Simon French.

Long road ahead

Some opinion polls reflect a comfortable lead for the 'remain' vote, while others suggest a narrow lead for the 'leave' camp. Panmure doesn't reckon the UK is in a particularly revolutionary mood, though, following the 2015 UK General Election and Scottish Referendum, especially given recent economic strength.

French believes sterling's volatility is simply piggy-backing on the referendum, not an inflection pointThey believe Britain will vote to stay, but with the referendum date now set for four months away, the campaign trail is going to be a long one. If the UK votes to leave, it will be a long time until the fine print is sorted anyway. This long period of uncertainty is likely to hinder the economy, with investments being held back.

UBS points to sterling being the first line of defence to wobble under the pressure. But French reckons the currency's volatility is simply piggy-backing on the referendum instead of being an inflection point. With strong macroeconomic data, a stable political backdrop and a growing working age population, the analyst is positive on the medium-term prospects for sterling, while UBS warns there is significant downside risk in the run up to June.

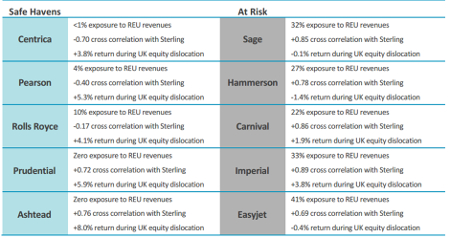

Admitting industry forecasts are merely "guesswork", Panmure has pulled together a list of companies to play on volatility.

He reckons utility firm , education outfit , defence and aerospace engineer , insurer and equipment rental company will be safe havens for the nervous investor (see table above). Software group , property giant , cruise holiday company , consumer goods manufacturer and budget airline are flagged as most at risk.

In a double-edged sword, French adds: "It is our strong view that none of the listed firms have their fundamental commercial prospects altered by the uncertainty ahead of the referendum, but that market sentiment may not be so sanguine."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.