Shift in fortunes for bombed-out Serco and Capita

25th February 2016 15:20

by Harriet Mann from interactive investor

Share on

The past few years have been a nightmare for outsourcer . Rival has problems of its own recently, too. A lot of the pain has been self-inflicted, particularly at the former where poor management was responsible for a string of profit warnings. But a turnaround is bearing fruit - more than can be said for Capita, which is looking distinctly sickly.

Serco chief executive Rupert Soames said Thursday that 2015, the first year of its recovery strategy, had gone "much better" than expected.

"In 2015 we delivered on our promises, our plan has survived first contact with the enemy, and we go into 2016 in much better shape than we entered 2015," said Soames. "However, to paraphrase the Duke of Wellington at Waterloo, we know that much hard pounding lies ahead."

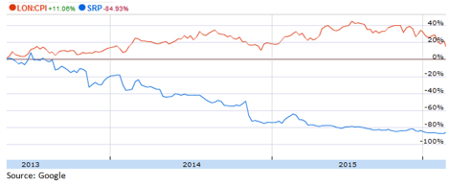

Serco had lost nearly 90% of its market value since 2013 after a string of profit warnings and series of scandals - the private security firm was caught charging the government for tagging criminals who were either dead or in jail. A subsequent review of its contracts resulted in a £1.5 billion write-down in November 2014, forcing a £90 million rights issue and renegotiation of debt terms.

A shake-up also drove focus toward supplying services to governments and selling its private sector outsourcing activities - Business Process Outsourcing (BPO). After ending its first "stabilisation" phase with the refinancing, the second "transformation" phase will end in 2018, taking the group into the third and final "growth" phase.

Total revenue slid 11% to £3.5 billion in 2015 and underlying trading profit fell 15% to £96 million, beating forecasts given at the time of the rights issue in March. Disposal and impairment charges caused an operating loss of £54.8 million, much better than last year's £1.3 billion deficit.

With the value of new signed contracts reaching £1.8 billion, over 700 individual customers placed orders in 2015 and Serco's forward pipeline rose by £1.5 billion to £6.5 billion.

There's no dividend, of course, but the rights issue and BPO sale shrunk net debt from £682 million to a far smaller-than-expected £77.5 million. The BPO deal will bring revenue down to £2.8 billion in 2016, of which £2.5 billion is already secured in the order book, and underlying trading profit down to £50 million.

"We have four priorities this year," says Soames, "further improve the operational and financial performance of our contracts; build our new business pipeline; reduce our costs; and improve and embed our new management information systems."

Investors are certainly taking the bait. Serco shares surged as much as 19% Thursday to their highest in 2016. But it wasn't the same story for Capita, which slumped by 6%, which completed its plunge to a crucial technical support level of £10 following mixed results.

Pre-tax profit more-than halved from £292 million to £112.1 million on a reported basis due to restructuring impairments. On an underlying basis, pre-tax profit inched 9% higher from over £535 million to £585 million, in line with broker Panmure Gordon's forecasts.

Cash conversion slipped four percentage points to 108% and free cash flow fell 5% to £348 million. Return on capital employed scaled back to 14.3% and the firm's pipeline has shrunk by 8% since December, starting 2016 with just a quarter of the contracts secured this time last year.

Capita has been exiting weaker businesses, which has driven margin improvements, but falling cash generation and conversion is unsettling.

Panmure analyst Michael Donnelley leaves estimates for profit and sales in 2016 unchanged, but remains a "seller" citing underlying concerns on goodwill, growth and quality of earnings.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.