Time to buy oil stocks?

7th March 2016 16:18

by Lance Roberts from ii contributor

Share on

Time to buy oil stocks?

The short answer is "No".

Let me explain.

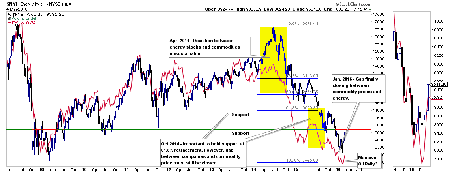

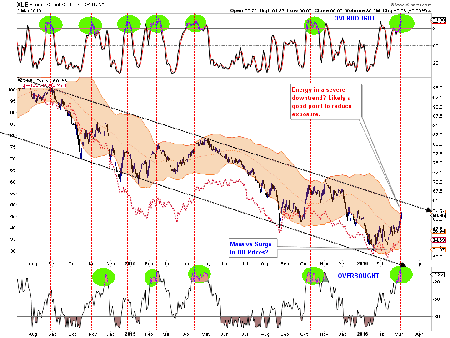

First, the rally in "oil prices" is a short-covering/extreme oversold move. While it "seems" like it has been a massive surge in the short term, as shown in the chart below, it barely registers on a longer-term basis. It is always important to keep some perspective.

The chart notes the dates of some of the calls I have been making in this missive since April 2014 when I recommended getting out of oil/energy entirely.

Notice that prior to 2014, the correlation between oil and energy prices was extremely correlated. The deviation I noted in 2014 is now in the process of being corrected, but is not complete as of yet.

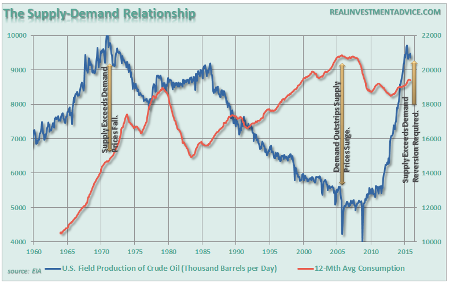

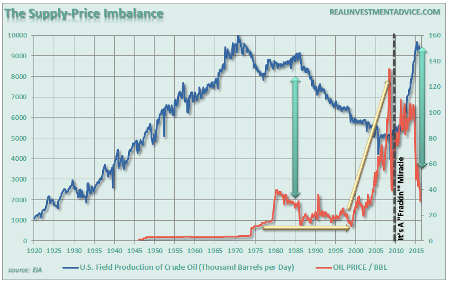

The decline in oil is not complete as of yet as there has been little progress in reverting the supply/demand imbalance. This will take several years to rectify and oil/energy prices will eventually settle into a trading range at these lower levels.

Again, for the sake of perspective, here is what happened to oil prices the last time supply and demand were this imbalanced.

As UBS recently explained:

Yesterday oil ended in the green despite a very large reported crude inventory build, a reflection of how biased to the downside sentiment and positioning already is. Today, crude started in the red and has been mixed from there but moving higher. And both days, the stocks have led with energy the best performing sub-sector in the S&P.

Now, there is no doubt that the performance recently is totally short-squeeze led. Though it also shows how negative sentiment and positioning is.

What has helped fuel this short squeeze?

• Positioning and sentiment very biased to the short side/underweight. And as we move up, the move is also exacerbated by short gamma positions that have to cover at higher levels.

• Despite high oil inventories (and still building), most upstream producers (from Exxon on down) have guided to lower than expected production as a result of lower capital expenditure (capex).

• Ongoing hopes of a potential agreement between OPEC and non-OPEC members (seems unlikely but now a meeting set for 20 March is reviving some market hopes).

• Credit players covering equity shorts - evident today that "good credit names" are under-performing and "bad credit names" outperforming.

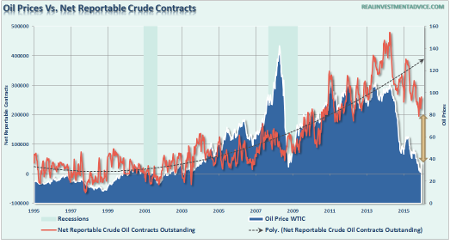

As shown in the chart below, the number of outstanding contracts on oil is still well above the long-term mean suggesting that more unwinding needs to occur before a longer-term bottom in oil prices is made.

With energy-related stock prices once again at extremes, the next most probable move will be to the downside. This is particularly the case given the recent builds in inventories and a likely disappointment from OPEC/Saudi Arabia on 20 March.

Furthermore, the damage to energy company earnings will be accelerated as the last of hedges begin to roll off over the next couple of months. This realization will push energy stock prices lower as companies are re-evaluated for much lower profit margins and rising bankruptcy risk.

More layoffs are expected. As this occurs the negative impact to the Houston real estate market accelerate as homes fail to sell, apartment inventories rise and commercial buildings remain empty. But such will not be just a localised event but as further reductions in CapEx occur the ripple effect to the rest of the economy will grow.

Note: If you don't think housing is about to become a problem, again, this piece by Aaron Layman should give you a wake-up call as interest only mortgages are back.

As Art Berman correctly stated in a recent interview:

"People think that the economy runs on money, but it runs on energy."

He also details in the interview how the current oil price collapse represents devaluation from over-investment in unconventional oil - and most commodities - because of cheap capital, and is simply a classic bubble.

"Continued oil prices of $30 per barrel (bbl) or less are the only reasonable path to higher growth and a balanced oil market. I think we're gonna get to $16.50/bbl. Normal is over, and there is no new normal yet."

It is well worth listening to if you think we have reached a bottom in oil/energy prices.

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of "The Lance Roberts Show" and Chief Editor of the "Real Investment Advice" website and author of The "Real Investment Daily" blog and the "Real Investment Report". Follow Lance on Facebook, Twitter and Linked-In.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.