How far can the commodities rally go?

8th March 2016 13:19

by Lee Wild from interactive investor

Share on

As is the trend these days, where the miners go, the is sure to follow. So, unsurprisingly, profit-taking in the commodities sector is the main reason why London's blue-chip index is nursing losses Tuesday. With many miners having surged by 50% or more since mid-January, investors are rightly wondering how far the rally has to run.

The timing and breadth of the upturn certainly caught many investors off guard. was the proverbial falling knife until January, since when its share price is up more than 160%. , once everyone's favourite dog to kick, is up 126% in the past seven weeks.

However, the rebound is sector-wide. The FTSE 350 Mining index has traded above 10,000 for the first time since October, and is up over 70% from 5,865. Africa-focused gold miner - formerly African Barrick Gold - is 76% higher, and Indian diversified metals giant , now run by old boss Tom Albanese, is up almost three-quarters.

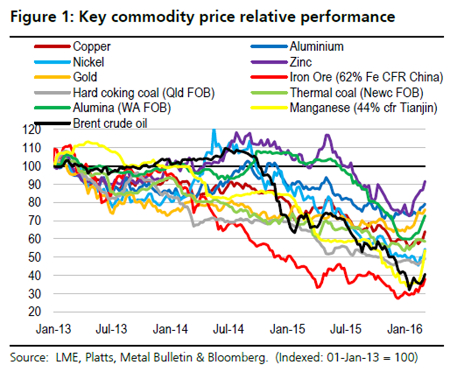

If miners are to hold these gains, commodity prices - higher now than at any time in 2016 - must too. According to UBS stats, manganese is up 49% year-to-date, iron ore 31%, and both alumina and zinc 21%.

But China has just reported a 25.4% slump in exports for February, the largest drop in over six years and twice as much as the market expected. "Such data, during what is typically a period of rising industrial demand for the world's no.1 consumer of commodities, is concerning," warns Investec Securities.

Bounce has some substance

This bounce does at least have some substance, though, given the macro influences at play.

Policy support in China and a renewed focus by the central government on economic growth rather than reform have boosted demand expectations there, says UBS. Spend on copper-intensive powergrid infrastructure leapt by 22% in the final two months of 2015, and investment is tipped to grow by 15-16% this year.

Speculators have moved from a near-record net-short position in January to a small net-longThe US dollar has weakened - typically good news for dollar-priced commodities - as traders bet that policymakers there will take a less aggressive approach to interest rate rises in 2016.

There have also been large inflows into commodity funds, and investors who placed big bets on falling metal prices have been forced to square off their short positions - short covering - to avoid hefty losses as prices begin to recover.

According to data, speculators have bought about 450 kilotonnes (kt) of metal, moving from a near record net-short position in January to a small net-long.

No major shift in fundamentals

However, UBS analysts Daniel Morgan and Lachlan Shaw argue that trade signals do not yet support a major shift to fundamentals.

"The current surge in commodity prices may be a short-term phenomenon from oversold market recovery and/or seasonal factors," they say. "Here, restocking activity and a normal seasonal lift of China's peak materials consumption mid-year could be at play.

Fundamentals suggest the iron ore price will retreat again - it needs to near $40/t to ensure medium-term market balance."Alternatively, we may actually find in a few months' time that a fundamental tightening of markets occurred in first-quarter 2016.

"While difficult for now to tell the difference, for sustainable price upside, we believe the most important factor is an acceleration of demand. Supply discipline and an end to cost deflation are also important, but we really need a demand shift."

As yet, the trade signals tracked by UBS do not yet suggest a big change to downstream demand, and it believes supply discipline has driven the outperformance:

"But without a demand shift, these rapidly lifting prices may face a supply price-cap. As prices climb the cost curve, some operators may be tempted to bring assets back from care and maintenance."

The team at Investec agrees, despite recent comment from Rio Tinto's top man at Pilbara, Michael Gollschewski, who says new iron ore supply should fall sharply in 2016:

UBS believes copper's rally is not supported by a big shift in demand or supply"There is not going to be much supply exiting the market at the current iron ore price, following yesterday's anomalous 19% jump to $63.7 per tonne," writes the broker.

"That said, there are few in the market that believe the current price is sustainable, with most commentary suggesting that it is a spike associated with short covering in the face of mildly encouraging signals from the China National Petroleum Corporation.

"Fundamentals suggest that the price will retreat again and we remain of the view that it needs to fall towards 'disincentive pricing' of around $40/t to ensure medium-term market balance."

And UBS has concerns. It believes copper's rally is not supported by a big shift in demand/supply; aluminium is blighted by structural oversupply, despite "robust" demand growth and, while seasonal factors should underpin iron ore prices - March to June is China's peak period of steel absorption - the latest couple of months reflect minimal demand pick-up.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.