Winter Portfolios: old reliable streaks ahead

1st April 2016 17:55

by Lee Wild from interactive investor

Share on

Seasonal investing is nothing new. Statistics going back 20 years show that share prices do best during the long winter months. This anomaly has made smart investors substantial profits for two decades, and last year we launched our own model portfolios based on the simple trading strategy. They were so successful we've done it again.

Known as the six-month strategy, all investors need do is buy a basket of shares on 1 November and sell on 30 April. Investing in the market between these dates only for the past 20 years would have turned £100 into £316. Over 10 years, it would have made twice as much profit as staying invested all year round.

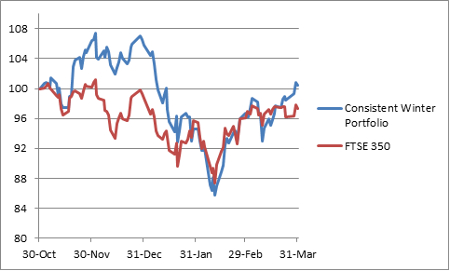

A year ago, we screened the FTSE 350 for the five stocks with the best record of returns between November and April over the past decade - the Interactive Investor Consistent Winter Portfolio. Last year it made a 14% profit compared with 8.7% for the FTSE 350 benchmark index.

We also relaxed the rules slightly to include companies with a track record of at least nine years, but which must have risen at least three-quarters of the time over the past 10 years - our higher risk Aggressive Winter Portfolio. Last year, it returned an impressive 16.9%.

Investing in this year's Consistent portfolio every winter for the past decade would have generated an average gain of 24% (excluding dividends) compared with an average of 5.4% for the FTSE 350. Gains for the Aggressive portfolio would have averaged over 35%, seven times more than the benchmark.

Here's a round-up of the highlights and lowlights from the penultimate month of this six-month strategy.

March round-up

After one of the most volatile periods in the past decade, finally some calm descended in March. The VIX, a measure of volatility known as the "fear index", fell to levels not seen in five months, and the FTSE 100 rose by 1.3%, or a little more than 100 points, over the four weeks. It also remained above 6,000 for an entire month for the first time since November.

Our benchmark index, the FTSE 350, was up 1.4%, but our Consistent Winter Portfolio rocketed nearly three times as much, and just one laggard stopped our Aggressive Winter Portfolio from pulling a similar trick.

Yes, there are ongoing concerns about the European Union referendum in June, but concerns about a slowing global economy have been put to one side, and the dollar has softened on indications that US interest rates will not increase any time soon. That's been a boost for the commodities sector and exporters in emerging markets.

Crucially, oil prices improved, gushing as much as 15% higher in March to over $42. Hopes are high that OPEC and other major producers will agree further production freezes at a meeting in Doha on 17 April. We'll see.

Consistent Winter Portfolio

A fightback begun in February spilled over into March, resulting in a 4% gain for our Consistent Winter Portfolio last month. Four out of the five constituents racked up big wins, with underperformer finally doing what we know it can, putting in a monthly gain of over 9%.

The workspace provider has done nothing much wrong since the portfolio strategy began in November, but the shares still plunged 28% from December highs. As we've suggested before, Regus has quadrupled in value since 2012, so it's all relative.

It's also interesting to see finance director Dominik de Daniel spending almost £1 million on Regus shares just after full-year results. Non-executive director François Pauly is stake-building, too.

Irish building materials firm has been a steady performer since day one, and March was no different. Full-year results at the beginning of the month were well-received, kickstarting a 7% rally which takes its overall gain for the strategy to over 10%.

And Gerard Moore at broker Investec thinks there's more in the tank. A broad US recovery may be underway, but a European recovery has yet to begin, he says. Margin guidance looks conservative, the valuation is undemanding and CRH has lagged peers this year.

Catalytic converters giant rose another 7%, continuing its bounce back from January lows. There's been little by way of corporate news other than the planned departure of finance director Den Jones over the summer this year. Analysts keep backing the blue chip firm, however. HSBC thinks the shares are worth £33 a pop.

is about as reliable as it comes. The maker of ingredients for make-up, anti-wrinkle creams and industrial lubricants has risen over the winter for at least the last 11 years, and it's up 5% this time following a 2.3% boost in March.

Yes, top-line growth has slowed, but a visit last month to Sederma, a long-standing part of Croda's Personal Care business located near Paris, impressed analysts. Charles Pick at Numis still thinks Croda is "quality stock" and reminds us that it still trades with the rights to 138p of dividends - the final of 38p and the special of 100p.

Bringing up the rear, and the only constituent to lose ground in March, is - down 6%. The equipment rental company has had a terrible 2016 and, as we reported last time, a cautious outlook statement from US peer United Rentals has really spooked the market.

Alongside third-quarter results at the beginning of March, management tipped capital expenditure (capex) to fall to £0.7-1 billion compared with £1.2 billion in the current financial year. It didn't put off bosses, though, who bought hundreds of thousands of pounds worth of stock as the shares sold off.

Aggressive Winter Portfolio

While Ashtead was the worst performer in both portfolio's in March, Regus was the best. - a laggard for the past few months - was next in line, up 2.2% this time. At the beginning of the month, the housebuilder reported profit up 34% in 2015 as volumes and sale prices both rose sharply.

Chancellor George Osborne's budget mid-month left the buy-to-let sector alone, while a new Lifetime ISA would help first-time buyers.

Gaming software firm was quiet on the corporate front, yet still rose over 2%. It's stopped publishing reports for the first and third quarters, so the next scheduled announcement is the AGM on 18 May.

However, management is thought to be close to completing more deals after the failed takeover of and Ava Trade last year. Broker Investec Securities has raised its sum-of-the-parts valuation from 850p to 910p, but admits that spending its cash pile wisely "would imply considerably greater potential upside".

Portfolio star finally gave up some ground, losing 1%, although it has risen 17% since the strategy began, so some profit-taking is understandable. Another farcical profits warning from does not help, although JD is currently head and shoulders above its arch rival.

We'll see if March was just a pause for breath soon enough. In April last year, JD rocketed about 18%. Could final results on 14 April be the catalyst in 2016?

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.