The outlook for ailing banks remains gloomy

5th April 2016 13:49

by Heather Connon from interactive investor

Share on

Eight years after the financial crisis sparked bank collapses, bailouts and mergers, the health of the sector is once more the subject of regulatory and investor concern.

In the UK and have cut their dividends, while and have announced more provisions against mis-selling and other wrongdoing.

In Germany, the German finance minister has had to reassure the stockmarket by going on record to say that he has "no concerns" about the stability of . Elsewhere in Europe some banks are in danger of failing the EU's latest stress test.

In the US banking giants such as and have been counting the cost of the collapse in the oil price in terms of higher bad debt provisions; investors fear smaller lenders could be fatally wounded if the price stays low.

Financial fund performance

In China there is growing fear about excessive - and lax - lending by leading banks. Small wonder, then, that bank stocks were among the worst performers last year and have had a poor start to 2016.

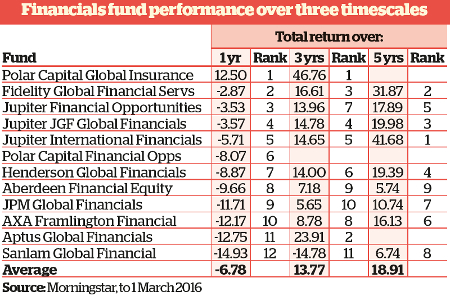

That is reflected in the performance of most financial funds. Data from Morningstar shows that the 12 open-ended funds specialising in this sector fell in value by an average of 6.8% over the year to 1 March.

That is well below the average global equity fund, which has lost 3.7% over the same period.

The lag is equally pronounced over longer periods. The Investment Association's global sector returned 17.7 and 31.1% over three and five years respectively, compared with 13.77 and 18.91% for financials funds.

Insurance focus

Those averages hide a wide disparity in performance, however. The clear leader over one and three years is , one of our sister magazine Money Observer's Rated Funds, which returned 12.5% over the past year and more than 46% over three years.

In a previous guise, as Hiscox Insurance Portfolio, the fund comfortably beat the rest of the sector over five years, returning more than 90%.

This fund focuses on insurance companies, so it does not invest in banks, fund managers or other financial companies owned by other funds in the sector. Indeed, its focus is very narrow: it invests largely in non-life insurers, and it has a concentrated portfolio of 30-35 companies.

That focus has been good for investors. Co-manager Nick Martin says that, over the 17 years of the fund's existence, it has produced 9% a year compound growth, 3% ahead of broader markets.

However, he adds: "The insurance industry as a whole [is not very good for investors]. It broadly makes only the cost of its capital. But the differential between good and bad is huge."

Martin has 17 years' experience in the insurance industry, 14 of those with this fund, while co-manager Alec Foster has been with the fund since its launch in 1998.

Among the key attributes they look for are management ownership of shares and remuneration arrangements that align the business with investors.

This, Foster says, "gives them an appreciation of risk". He points out that, by definition, insurers take onto their balance sheets risks that others do not want.

He adds: "We like management teams that think in a conservative way, consider what could go wrong and evaluate aggregate risk across their portfolios."

He admires , the US insurance giant. Its market value has not changed in 10 years, but its dividend has increased by 10% a year during that period, and it has bought back almost half its shares.

The result has been a return of around 10% a year. "The management team couldn't care less about its market capitalisation, but that is unusual among European and Asian businesses," Foster says.

Many of the fund's holdings are listed in the US and Bermuda, where share buybacks rather than dividends are the norm. But income has been high enough for it to offer a 2% yield.

Unpredictable climate

The world's climate is becoming more unpredictable (with severe events such as hurricanes and floods more commonplace), cybercrime is rising and the threat of terrorism is growing, but Martin believes these trends create an opportunity for insurance companies by demonstrating the value of insurance policies.

Moreover, although companies such as have been considering offering personal insurance, while technology such as driverless cars and smart homes may reduce the need for motor and contents insurance, commercial underwriting is so specialist and requires such large reserves that it is less vulnerable to such pressures than most market sectors.

Martin says his fund is the only one he knows of that specialises in insurance. General financial funds can, however, have insurers in their portfolios.

has about a quarter of its assets in the insurance sector, while and Money Observer Rated Fund both have more than a fifth of their assets in insurance.

Nor are these more general funds restricted to banks. Stock exchanges, asset managers, leasing and consumer credit businesses are also widely held by these funds.

Four of the top 10 holdings in Jupiter International Financials, for example, are stock exchanges: , , and index provider .

Jupiter Financial Opportunities' manager, Guy de Blonay, says these businesses are based on fee income, which can be more stable than interest margins or lending book growth.

They may actually benefit from market turbulence rather than be damaged by it, as investors use derivatives and other hedging products to protect their investments.

Furthermore, irrespective of whether markets are falling or rising, investors will still use the indices compiled by MSCI and other providers.

"I am looking for companies that can exploit volatility but are not affected by interest rate decisions," he says. "I focus on companies with fee income and strong pricing power."

Banking sector faces challenges

De Blonay says there has been significant wealth destruction in the banking sector. Some banks are trading at lows last seen during the financial crisis.

Deutsche Bank's shares have lost more than 40% of their value over the past year, shares have fallen only marginally less and Standard Chartered's have more than halved in value.

He says the banking industry has transformed itself since the crisis. But it still faces challenges, including the plunging oil price - which could drive up bad debt (particularly among US banks) - and the move in countries such as Japan, Denmark and Sweden and even the US to cut interest rates to below zero.

"That is unattractive, particularly for retail banks," says de Blonay. "Their net interest margins will suffer if central banks face pressure for negative interest rates."

He says the mood has changed since the second half of 2015, when investors were excited about the prospect of the US raising interest rates and there was an expectation that interest rates were on the way up. Deflationary pressures are now rising, while interest rate expectations have fallen.

It is not all gloom, however. De Blonay points to Lloyds Banking Group as an example of a company that is doing better, despite the external pressures. In February it announced a better-than-expected dividend and a 0.5p a share special dividend, giving it an excellent yield.

He says: "In a low interest-rate environment, investors will pay more for a progressive dividend policy and a higher payout ratio.

"They will also pay up for a single-country centred business that is more focused on retail banking or fee-based businesses such as investment management, and is well capitalised."

These kinds of businesses are in demand among investors, however, while the more distressed banks stand at discounts to their net asset values.

But taking a contrarian view and buying into these would mean "you would have to be confident about the macro outlook", according to de Blonay. With uncertainty increasing - if anything - rather than falling, that would be brave.

In contrast to the pre-crash period, many banks now offer relatively low yields, and many are cutting payouts.

Investor interest now focuses more on recovery potential rather than income, but the extent of global economic uncertainty makes calling the start of the recovery very difficult indeed.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.