Could 2016 finally be the year for value investors?

11th April 2016 17:16

by Alex Wright from ii contributor

Share on

2016 is shaping up to be a very interesting year for UK equity investors. This is not because the market looks particularly attractive or unattractive as a whole, but because company valuations seem to imply a high probability of a US and global recession which is yet to materialise.

Labels such as "quality" and "defensive growth" are used to describe companies where the market perceives a high degree of stability in their earnings and dividends.

Although it intuitively seems sensible to invest in quality stocks in the face of a somewhat uncertain macroeconomic outlook, the last two years have seen a magnitude of outperformance which is usually associated with times of extreme economic stress, rather than modest recovery (see table one below).

The prices you are asked to pay for these companies today leave little margin for error.

Complacency can leave you exposed

Many investors seem to be positioned for this trend to continue indefinitely. While it is easy to take comfort from a successful period of outperformance, complacency can leave you dangerously exposed if patterns of market leadership evolve.

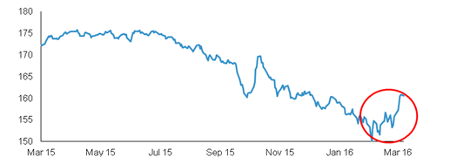

The last few weeks have offered early signs that a change in leadership could be underway (table two below) and, in many cases, investors' positioning over the past two years will have left them ill-prepared for this.

My clients will know me as a contrarian bottom-up investor, and usually I am keen to reduce as far as possible any macro or thematic biases to the fund.

However, in the current environment, a contrarian investor cannot help but be attracted to those parts of the market that don't fit the quality perception, and where a wider range of investment outcomes is possible.

Many of these "value" categories have some exposure to the economic cycle. Using broad brushstrokes, banks, oil and construction all stand out to me as areas that seem to be pricing in a recession.

Muddling through

There is a good deal to be worried about in the global economy (when isn't there?) But based on the many conversations my team and I are having with company managements, I believe the chances of a "muddle-through" scenario are much better than the market expects.

So far, it seems that the adjustment underway in industrial sectors can occur without a severe hit to confidence in the all-important service and consumer sectors.

Unemployment in the US and UK continues to fall, and incomes are showing solid growth. Outside of some industrial and emerging market-facing sectors, we are not currently facing a recessionary scenario.

If this more benign macroeconomic picture endures, I believe the market will re-appraise the prospects of the stocks currently in the reject bin, and the gulf of valuations will have to narrow.

Could 2016 finally be the year for value investors? In my experience, when the risk premium is so high, it can help to focus on the fact that the price you pay for the stock more than fairly compensates you for the uncertainty of the outcome.

Alex Wright is portfolio manager of Fidelity Special Values plc.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.