Royal Mail shares threatened by pension talks

15th April 2016 14:04

by Lee Wild from interactive investor

Share on

Labour negotiations begin at soon. Its main union, the Communication Workers Union (CWU), wants a 35-hour week by 2020, paid for by productivity gains, and will oppose any attempt by the company to shut the generous final salary pension scheme. But it's the pension issue which is a major swing factor as to the valuation of Royal Mail.

"We believe that, in the short term, it is the most important financially," argues UBS. Demands for a ban on compulsory redundancies, severe limitations on outsourcing, and the introduction of postmen spending a whole day out of the depot on the rounds, are negotiable, it says.

However, the current pension situation "cannot continue" given the difficulty in keeping the scheme open. It currently costs Royal Mail £350 million a year in cash contributions to the defined benefit (DB) scheme.

Shut it, and transfer members to the defined contribution scheme, and RMG could save up to £220 million a year. Keeping it open could cost another £255 million. Worst case, if the scheme requires a similar payment to the Post Office scheme, is a £590 million cost per annum. RMG's free cash flow is estimated at only £400-450 million by UBS.

"We believe the market is pricing in the continuation of the current cash cost, given RMG trades more on free cash flow yield than headline earnings," writes UBS analyst Dominic Edridge. "In the event of a pension agreement where the DB scheme remains open - or where newer employees receive higher contributions, we believe there would be a negative reaction."

Of course, RMG also has to worry about negotiations over wages and regulator Ofcom. A push from to increase the number of Prime parcels delivered by its own network from 50% to 80% will also keep UK parcel prices keen "for at least another 18-24 months".

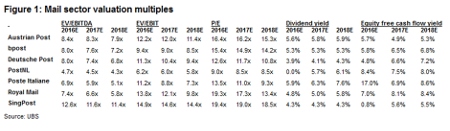

UBS believes RMG's current valuation - a small discount to peers on a calendar year 2017 equity free cash flow yield basis - "appears reasonable". There is, however, a wide range of potential outcomes - 17% upside, 24% downside - "given the material uncertainties in the next 18 months".

And, less than five weeks before RMG publishes results for the year to March 2016, Edridge's earnings estimates are way below consensus. Underlying earnings per share fell from 32.2p to 21.1p in the year to March 216, he thinks, versus the market at 36.1p. Forecasts for March 2017 and 2018 of 26p and 28.2p, respectively, are also way below the City average of 39.4p and 41.1p.

Still, the prospective dividend yield for 2017 is 5%, and the analyst nudges his price target up by 8p to 488p and sticks with his 'neutral' rating.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.