BHS failure a sign of things to come?

25th April 2016 14:26

by Harriet Mann from interactive investor

Share on

A staple of the high street for generations of Brits, British Home Stores (BHS) has officially filed for administration. Emergency talks about a rescue package for the 88-year old business failed, and administrators will no doubt keep hawking the business around to potential buyers. Good luck. Despite record low interest rates, this is no golden era for retailers.

With 11,000 jobs at risk, this is the largest UK chain to fold since Woolworths in 2008. And finding a white knight like Mike Ashley's was always a long shot, given a £571 million pension deficit had swollen debt to £1.3 billion.

Once owned by retail tycoon Sir Philip Green, businessman Dominic Chappell bought BHS from the Topshop owner for just £1 last year, leading a consortium of financers called Retail Acquisitions.

The group pledged to raise £160 million to turn the chain around, but failed to raise the amount amid falling sales and rising rents. In a final stay of execution, the group managed to secure a rent cut in 87 of its 164 stores last month, but that's nowhere near enough.

Operating in one of the most competitive sectors, many UK retailers have undergone a huge transformation both in stores and online over the last few years. But BHS has clearly failed to revive a format which looks increasingly out of place in today's high street. It's been very much a Jack of all trades, master of none. However, it's not the only one to have struggled.

More recently, the retail sector has found it difficult convincing Brits to part with their cash, despite record low interest rates and price cuts. In the latest sign that households are nervous about the economic backdrop, retail sales slipped 1.3% from February to March and by 0.1% year-on-year, according to the Office for National Statistics. A 2.7% increase in volumes was way less than the 4.4% growth forecast.

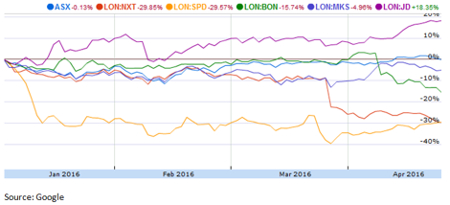

With pressure from the new Living Wage and online investment, earnings forecasts have been cut by around 5% across the sector over the last six months, which has hit many retailers hard. Just four months into 2016 and the sector plummeted from the decade-high valuations seen in 2015. Broker Peel Hunt has cut its profit forecasts for the sector by 6.5% over the last year, representing a 3% downgrade over the last quarter.

All retailers have to cope with rising costs. Internet shopping and the Euroepean Union referendum are making life tough, too. Passing those costs onto the consumer is proving more difficult than ever, so margins are bound to suffer if not managed well.

Of course, not all retailers should be tarred with the same brush. There are plenty of savvy shopkeepers out there.

Biggest Losers

Sports Direct had a terrible year, with a shock profits warning and confession from its loose-lipped boss that it was "in trouble" sinking the shares to four-year lows. Demand has picked up over the last month, but the 16% rally has only recovered the shares to mid-March's price. The boss's "pile 'em high, sell 'em cheap" model is failing to get customers through the door, despite the current fad for sportswear chic.

It's been a completely different story for its high-quality rival , which has surged by 18% in the year-to-date, fuelled by this seemingly unstoppable demand for trainers and trackies. In the year to 30 January, revenue jumped 20% to £1.8 billion and pre-tax profit rose 45% to a record £131.6 million. Struggling department store has also done well, although there's more to be done here.

The red lights are flashing above , however, after chief executive Lord Wolfson warned that 2016 would be the hardest year since the financial crisis. It's why, despite decent annual results, the shares have collapsed to their lowest since 2013. And they're still falling.

Clearly, the ripples of Wolfson's warning are still being felt and, although new boss Steve Rowe admits clothing sales aren't yet up to scratch, the numbers weren't as bad as feared.

However, M&S has struggled to make its fashion lines work. Its shares look inexpensive and there's a generous dividend yield, but it will be praying that its new face of fashion, Alexa Chung, has the desired effect. It's technology had better be up to it, too. We just had to wait to get access to the website.

Updating the business model is also taking too long for some. Just look at plus-size and over-50 retailer as it attempts to turn from mail-order retailer to online-savvy group. After a disappointing set of results - pre-tax profit is down 2% at £84.5 million despite double-digit growth in the second half - the shares have plunged to four-year lows.

Life is tough for nearly every retailer right now. Those who aren't on top of their game - even some of the big names - could easily go the same way as BHS and Woolworths before it.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.