Mining sector: 'buy' or 'sell'?

5th May 2016 13:19

by Harriet Mann from interactive investor

Share on

With Chinese economic growth slowing down, but plenty of commodity supply sloshing about, the largest mining sector rally in five years is at risk of unravelling fast. The market, however, remains difficult to predict, and a rally in 2009 in similar conditions lasted almost two years. So, what next?

A Chinese investment-led surge in steel prices has underpinned a stellar start to the year for the mining sector: it's surged by 37% in the year-to-date and the shares are sitting nearly two-thirds higher than their January lows. Since the beginning of the year, the iron ore price is up by over half, zinc has jumped by a fifth and gold by 22%.

But there's a real sense that this macro backdrop is only temporary, especially with two US rate rises expected in the second half of the year. "It is hard not to agree with the view that this is an opportune moment to take profits," write industry analysts at Barclays, although there is a "but".

"In the short term (six months) we believe that the 'network effects' from the growth in credit, property prices, developer activity and consumer demand may support economic growth rates [in China] and with it higher than expected commodity demand."

With the miners expecting more cash for their production, 2016 earnings guidance has inevitably jumped across the board. Barclays has upgraded Brazilian giant earnings forecast by 37% and by 27%.

More conservative upgrades have been given to , and , up 18%, 16% and 7% respectively.

Barclays downgrades sector cash profit forecasts for 2017 by 3%, although lower depreciation and interest charges trigger a 12% upgrade to earnings.

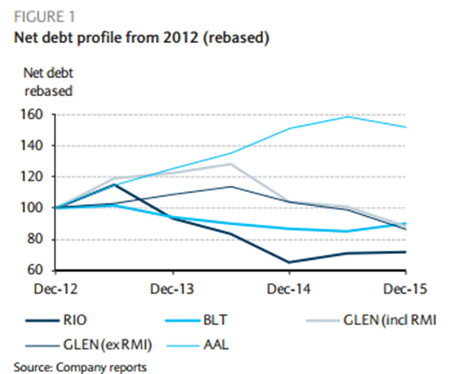

When the commodities super cycle ended abruptly in 2014, miners were forced into aggressive cost-cutting to protect vulnerable balance sheets. With all capital investment budgets slashed and dividends cut, sector balance sheet have de-geared rapidly, led by mining heavyweight Rio Tinto - net debt/cash profit should fall to just 0.4 times in 2017 based on spot prices.

Of course, companies must still make sure they are well-positioned to take advantage of any recovery in commodity prices, but Barclays believes big capital expenditure cuts are "at an end". That should mean impairment charges start to fall, although return on equity remains low and operational costs will come under pressure from foreign exchange rates and higher oil prices.

As long as the industry continues to protect balance sheets, current valuations look supportive, argues Barclays. On its more conservative estimates, free cash flow yields are averaging 4.3% and 6.3% for 2016 and 2017, although this could rise to 8.3% and 13.2% on spot pricing.

With the market rewarding cost-cutting, share prices have soared despite some pretty serious losses still being reported. But there's another noticeable trend: shorting. Bearish investors borrow shares to sell at a high price and then buy back at a low price, bagging the profit. Barclays reckons 7.5% of Anglo's shares are on loan, compared to the 1% at both Rio and BHP.

However, that's much less than before, implying that short-sellers have been rushing to buy back stock to either pocket profits or limit losses.

"For Anglo American that figure has come down from 22% at the peak in February, implying 15 straight days of buying to cover, while the remaining short would require a further seven days to cover. This suggests potential for AAL to continue outperforming until short interest normalises," says Barclays.

For now, the broker sticks with its 'neutral' rating on the sector, although for the best exposure they suggest looking for quality and gold - the yellow metal had its best quarterly growth for 30 years in the opening three months of 2016.

Barclays' tips

Barclays' top pick is Rio Tinto, with a recent target price upgrade taking fair value to £23 - that's 7% upside. Thanks to a more reassuring balance sheet, recovering oil prices and valuation support, the analysts have also upgraded BHP to 'equal weight', valuing the shares at 875p.

Unfortunately, things aren't as rosy at Anglo American, with concerns over its asset quality and balance sheet locking it in 'underweight' territory. Priced at 643p, Barclays' 550p target price implies 14% downside.

Upgrading its price target on by nearly a third to £63 still leaves it below the current £66 following recent outperformance. is another of Barclays' top picks for gold exposure, with a 300p target price representing 32% potential upside. has caught the eye of the analysts, too, and they reckon it's worth 145p a share, 27% more.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.