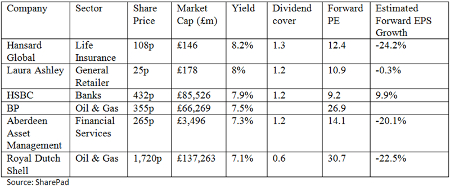

Six super dividend yields to consider

6th May 2016 14:28

by Harriet Mann from interactive investor

Share on

Traditionally, investors split into two camps: growth or income. Yet against a backdrop of rock-bottom interest rates, it's much harder to differentiate between the two. Yields once regarded as a red flag are now accepted as almost normal as every man and his dog chases income.

No one wants to sit on cash in a stingy ISA or current account, but should investors pick companies on dividend yield alone? We examine the merits of six of the most interesting high-yielding stocks on the FTSE All-Share index right now.

Dividend yields should never be taken at face value. It sounds simple enough: a high dividend yield means you will get a larger percentage of the stock price returned to you in addition to any appreciation in the share price. But, due to their inverse relationship, sky-high yields imply risk and can be the immediate result of a plummeting share price, the forerunner to a painful dividend cut.

There have been some high profile dividend cuts in the last year, most notably at grocers , and , and miners , , and . Major profit warnings caused all of these shares to plummet in value, sending yields rocketing and making cuts to payouts inevitable.

That's why it is always worth digging deeper. Another important tool is dividend cover - how many times a company can pay its dividends from net profit. If a company has a lofty yield but can't even pay its dividend from one-year's profit, that's a major worry.

An appropriate dividend cover for a stock is subjective, however, with some arguing that a higher figure suggests a company isn't doing enough with its profits, including paying out enough to shareholders. Earnings growth history and guidance are also worth watching.

While most would advise against emotional investing, sometimes it is worth looking beneath the traditional valuation models. Take , for example. The oil giant would probably not make it through strict screening processes using consensus estimates, with a questionable dividend cover, relatively high price/earnings (PE) multiple and falling profits. However, Shell remains a great story based on a number of potential positive catalysts.

The explorer's £35 billion acquisition of BG certainly broadens its exposure to liquefied natural gas (LNG) and regasified natural gas and has already helped boost production. A forecast 23% decline in EPS for this year is more modest than the 83% plunge in current cost of supplies (CCS) earnings to $814 million (£563 million) in the opening quarter. Add the fact that Shell hasn't cut its dividend since World War Two, and the payout begins to look relatively safe.

Controversially increasing its dividend just before the gravity of the commodity rout was felt, rival has so far managed to sustain its eye-watering returns to shareholders, currently over 7%.

Insurance group trades at a 23% discount to net asset value (NAV) and offers a prospective dividend yield of 8.2%, covered 1.3 times by earnings. After years of falling revenue, Hansard has parachuted in a new sales boss to steer the group back to growth.

After an encouraging first half and with little impact expected from possible Brexit, the group has made broker Panmure Gordon's Conviction List. The analysts look to a strong third quarter as proof that the corner has truly been turned.

Over the last three years, retailer share price has been pretty stable, with an early 2015 rally to near 35p now unwound back to its 25p support. , on the other hand, has halved from its plus-500p high in early-2015, under pressure from volatile financial mar kets and growing global economic concerns.

Although there is still a lot of work ahead to swing falling profits back to growth, chief executive Martin Gilbert has said he wants to maintain the progressive dividend policy, even if that means dipping into its regulatory capital buffer.

7.8% dividend yield reflects a share price down by a third over the last year, but the Far East-focused bank got off to an encouraging start to the year in a difficult market, with three-month results 11% ahead of expectations and management committing to a progressive dividend policy.

Analysts at brokerage Shore Capital aren't convinced, however, and have pencilled in a 37% cut to $0.32 a share - although they note this will likely come with the management change - it will need both a new chairman and chief executive. Gary Greenwood is concerned that long-term profitability is not secure, especially with global volatility making accurate guidance incredibly difficult.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.