Sweet like (Hotel) Chocolat

10th May 2016 15:07

by Harriet Mann from interactive investor

Share on

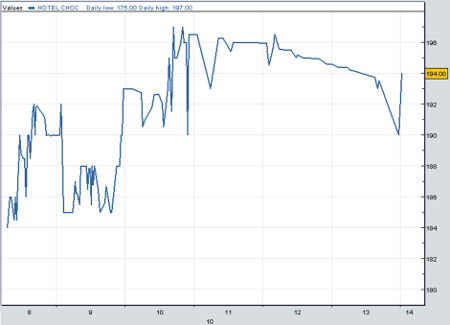

As stockmarket debuts go, first day on AIM has got investors' taste buds tingling: the chocolatier has already soared by over a third! It's just raised £12 million to bankroll a store roll-out programme, fund a digital revamp and expand its Cambridge chocolate factory. Cash profit is already up 41% in 2016, and the market clearly expects a sweet year.

Selling shares to hungry institutions at 148p also raised a further £43.5 million for founders Angus Thirlwell and Peter Harris. And the pair, chief executive and development director, respectively, will still own 66.6% of a business currently valued at £219 million, £52 million or 31% more than at the admission price.

The premium chocolate company is best known for pairing weird and wonderful flavours with its chocolate - its Eton Mess, Marzipan & Amaretto and Dark Ginger flavours are firm favourites among sweet-toothed customer. Fancy carrot cake in a chocolate? What about Caramel or Strawberry Cheesecake? Or, for those who like a tipple, perhaps the mojito, rum or gin chocolates take your fancy.

Founded in 1993, Hotel Chocolat sells its chocolate and cocoa-related products - think salted caramel vodka, cocoa gin, and pale cocoa beer - online and through its 84 stores. Although it has shops abroad, 94% of last year's sales came from the UK - its three stores outside the UK are in Denmark. Customers can also join a monthly Tasting Club, or access the products through its wholesale arm or Saint Lucian estate in St Lucia.

It opened a hotel, spa and restaurant on the cocoa plantation in 2011, which generated sales of $2.5 million (£1.7 million) in 2015, with cash profit of $0.4 million.

Investors will be looking forward to maiden results: Hotel Chocolat generated £82.6 million of revenue in the year to 28 June 2015, with cash profit of £8.1 million. In the first half of this financial year, the chocolate group has already generated £55.7 million and £11 million, respectively, that’s up 14% and 41% respectively.

There's a lot of potential here for growth, too: Hotel Chocolat currently only has 0.5% of the UK's £20 billion gift market and accounts for just 2% of the lucrative £6.4 billion UK chocolate market. Management reckon they can take advantage of the UK cafe culture, too.

Investors are clearly convinced by Tuesday's maiden surge, which comes less than a year after Ferrero paid £112 million for high street confectioner Thorntons. And investors clearly have an appetite for tasty treats.

Baker joined the London market in May 2014, and it's now worth nearly twice as much at £325 million, or 328p a share. It was much more until the shares began to fall in January.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.