Return to a structurally sound bull market?

25th May 2016 10:40

by Lance Roberts from ii contributor

Share on

Lack of low-hanging fruit

As I suggested previously, the "seasonally weak" period of the year may be a good opportunity to reduce risk as we head into the "dog days of summer".

"Does this absolutely mean that markets will break to the downside and retest February lows? Of course, not.

"However, throw into the mix ongoing high-valuations, uncertainty about what actions the Federal Reserve may take, ongoing geopolitical risks, concerns over China, potential for a stronger dollar or further weakness in oil - well, you get the idea. There are plenty of catalysts to push stocks lower during what is typically an already weak period.

"Should you 'sell in May and go away'? That decision is entirely up to you. There is never certainty in the market, but the deck this summer seems much more stacked than usual against investors who are taking on excessive equity based risk. The question you really need to answer is whether the 'reward' is really worth the 'risk'?"

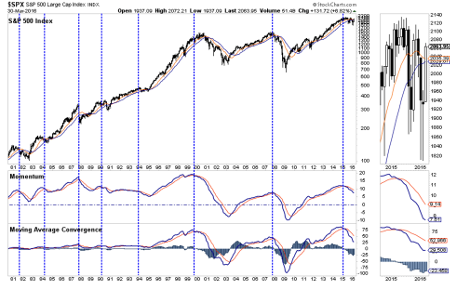

While the recent rally has certainly been encouraging, it has failed to materially change the underlying momentum and relative strength indicators substantially enough to suggest a return to a more structurally sound bull market (valuations notwithstanding).

With price action still confirming relative weakness and the recent rally primarily focused in the largest capitalization based companies, the action remains more reminiscent of a market topping process than the beginning of a new leg of the bull market.

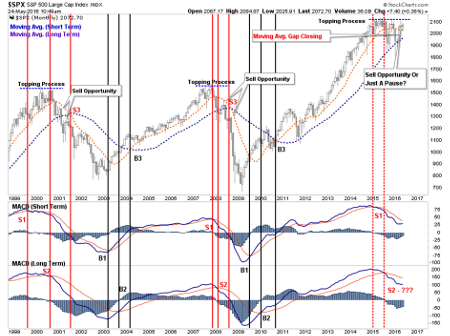

As shown in the last chart below, the current "topping process", when combined with underlying "sell signals", is very different from the action witnessed in 2011.

While I am not suggesting that the market is on the precipice of the next "financial crisis", I am suggesting that the current market dynamics are not as stable as they were following the correction in 2011.

This is particularly the case given the threat of a "tightening" of monetary policy, combined with significantly weaker economic underpinnings. The challenge for investors over the next several months will be the navigation of the "seasonally weak" period of the year against a backdrop of warning signals.

Importantly, while the "always bullish" media tends to dismiss warning signs as "just being bearish", historically such unheeded warnings have ended badly for individuals. It is my suspicion that this time will likely not be much different, the challenge will just be knowing when to leave the "party".

'You get recessions, you have stockmarket declines. If you don't understand that's going to happen, then you're not ready, you won't do well in the markets.' - Peter Lynch

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

To read Lance Roberts' full article, click here.

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of "The Lance Roberts Show" and Chief Editor of the "Real Investment Advice" website and author of The "Real Investment Daily" blog and the "Real Investment Report". Follow Lance on Facebook, Twitter and Linked-In