Are we about to witness the death of oil?

26th May 2016 14:07

by Douglas Chadwick from interactive investor

Share on

It's official: we are about to witness the death of oil. At least that would seem to be the verdict of many financial pundits and commodity forecasters. Solar energy capture and hydrogen fusion technology will give the world unlimited cheap green energy.

Presumably this will lead to the end of famine and drought, and nobody will be cold ever again. Mankind will have triumphed and the new technologies will have won through over "nature".

My question is whether and when this "dream world" will become available to us all. The Saudis, the oil kings of the planet, must think that it is imminent, as they have announced that they intend to sell off part of Aramco and use the money to pay off debts whilst diversifying into other industries.

In the last two years the price of oil has dropped from $120 a barrel to below $30 a few months ago, only to recover to around $45. It's increased by 50%, but it needed to go up 400% to get back to where it was in 2014.

Impossible job

On the supply side, knowing that this breakthrough technology is rapidly becoming available, at what stage and price will the oil industry start to shut down its exploration and research?

The North Sea and the Mexican Gulf oil fields are expensive to operate. The Alaskan and Russian pipelines are costly to maintain in order to keep the oil flowing through frozen lands. Shale fields and potential fracking plants will struggle to justify their development.

With this background, the directors of these industries have an almost impossible job to decide how much to cut back and when to make these cut-backs.

On the development side, there will be changes in engine design for planes, trains and cars, with the corresponding need for factory refurbishment to cope with this new demand and the corresponding demise of the obsolete.

Cheaper oil could create new demand

A large percentage of houses, office blocks and factories will generate solar energy and store the electricity they need, thereby making themselves relatively independent of the national grids.

But these will still have to exist in order to supply power during the years of changeover and to those sections of industry and the community that will always require this form of secure supply.

The agriculture industries around the world will still demand fertilisers based on oil conversion, and this is likely to increase as more non-productive land is brought under cultivation. The plastic industry won't go away and cheaper oil may generate more demand.

So again, the question will be: how much oil is going to be required and how to budget to meet this still sizeable remaining demand?

Which of the oil-based economies will be the ones to continue to supply this falling world demand?

OPEC has never managed to reach agreement on how much should be brought out of the ground in the past, and how production should be shared out, so I do not hold out much hope for future rationalised agreement.

Let us hope that countries such as Russia, Brazil, Venezuela and many of the Middle East nations do not allow future economic shortfalls to result in social unrest, which then ends up in conflict.

Stockmarket evolution

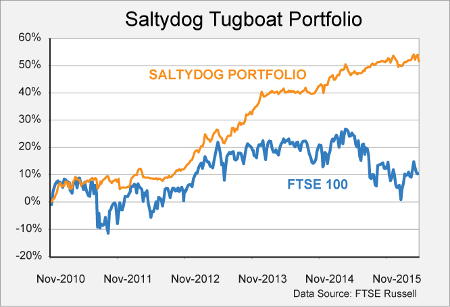

The Western world's main market indices such as the Dow and the FTSE 100 are heavily reliant on oil-based businesses such as , , , and the like. These companies must surely now start to fall out of the limelight as demand for their product reduces and their earnings fall.

What then happens to these national indices and the pension funds heavily invested in them? My uneducated guess is that they will suffer until new companies come along to allow this century's technologies to take their place. Maybe some of these old companies will reinvent themselves and evolve.

Now I really do not pretend to be any sort of authority on how the future will develop, and of course I will have got certain things wrong.

But one thing that I have got right is that in a relatively short time, say 30 years, there are going to be changes created by new technologies which will rival those that occurred during the Industrial Revolution.

Some of these have already started and we should all be alert to the ways they might affect our investments.

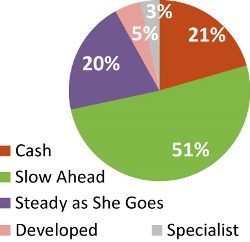

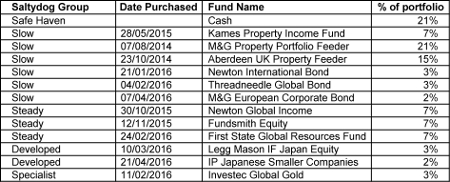

Since last month, we have increased our cash holding in the run up to the European Union referendum. We have already reduced our exposure to the UK property funds and the global bonds, and now our equity exposure is focused outside of Europe.

If the funds that we are currently in stop performing, then we would anticipate increasing the cash even further.

This article was originally published by our sister magazineMoney Observer here.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.