Stockwatch: A tuck-away with short-term fire

31st May 2016 12:37

by Edmond Jackson from interactive investor

Share on

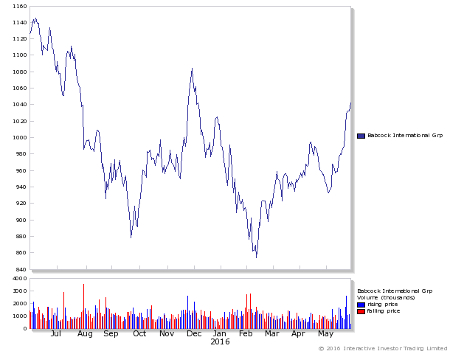

Can build on its rise? At 1,030p, the FTSE 100 shares in this engineering support services group are recovering after a New Year drop to 854p, which coincided with the plunge in oil prices (see chart below).

This was ironic, given oil industry work is just one activity within Babcock's Mission Critical Services division and represents only 13.5% of group operating profit - but the market was minded to slash any stock featuring "oil".

Its recovery quite follows the turnaround in oil prices, yet Babcock's latest results for the year to end-March are a reminder that this is an overall robust group with good medium-term prospects.

Double-digit growth

Underlying progress is at or near double digits: pre-tax profit is up 10% to £459.7 million on revenue up 8% to £4,842.1 million, with earnings per share (EPS) up 8% to 74.2p and the total dividend up 9% to 25.8p.

Management emphasise this is due to a strong operational performance, its key markets have remained positive and a £20 billion order-book provides clear visibility of future revenue growth. Over 40% of new contract bids have been successful in the last year, rising to 90% for renewals.

Divisional progress is mixed with, operating profit up 14% to £198.9 million in the marine and technology business, defence and security rising 2% to £131.3 million and support services up 6.6% to £107.9 million. However, the international division fell 7.9% to £107.6 million, mainly due to difficult trading in South Africa, which has suffered from plunging commodities.

Defence the best line of attack

So the results are buoyed by progress at the relatively more significant marine side, which serves the Ministry of Defence by maintaining naval infrastructure and assets through long-term partnerships supported by the 2015 Strategic Defence and Security Review.

This helps explain confidence in visibility and is a positive factor for the stock's rating; it also emphasises continuity of government where change could interrupt what can be a two-year process of contracts' tendering and awards.

Presently a key aspect is being part of a consortium replacing Trident nuclear submarines; so while a Corbyn government might not prove a kiss of death, the Labour leader's opposition to Trident is not what this stock wants to hear. Current progress reflects defence priorities typical of a majority Conservative government that is committed to increase defence spending over five years.

The spread of activities reflects acquisitions and helps mitigate the risk of setbacks, yet can make Babcock rather complex to understand and value - and also means a goodwill-heavy balance sheet, hence the negative trend in net assets per share.

The £1.6 billion acquisition of helicopter services group Avincis two years ago is now fully integrated into Mission Critical Services, although management had said it would take three years to gain traction in new areas with governments and the public sector.

Undemanding valuation

The table shows the latest price/earnings (PE) multiple in the high teens, but if the group can post anywhere near consensus forecasts of pre-tax profit rising over £500 million then the PE drops to the low teens; meanwhile the prospective yield would be covered nearly three times by this earnings scenario and cash flow would have consistently beat earnings.

Key financials are therefore attractive, assuming management's budgeting/guidance is fair, as it implies a 40%+ jump in EPS this year. The market may re-rate the stock only as updates or results prove this scenario, yet Babcock could work out well as a tuck-away.

Since the latest results, five brokers have published 'buy' or 'overweight' advice targeting 1,121p to 1,4276p i.e 9% to 39% upside before dividends, with only Citigroup a 'seller' targeting 850p.

Although the shares have fallen 4% in the six months since I drew attention to the stock at 1,080p after the New Year sell-off, the investment case remains intact.

Mind, a stock like this could slip again if the Conservatives' infighting over Europe leaves the party weakened and leads to Labour gaining in the poll, however the latter has much to do to convince voters on its handling of the economy.

High debt levels falling

Net debt is down 7.3% to £1,228.5 million on the year and is expected to fall further, thanks to a cash conversion of operating profit of over 100%.

The cash flow statement shows net cash from operations up 14.9% to £490.3 million, which is helping £111.3 million loans to be repaid - relatively modest in context but moving in the right direction. The balance sheet still cites year-on-year cash up 42.3% to £185.9 million after £121.5 million was paid out in dividends.

The income statement shows net finance costs lopping a total £74.9 million off £539.7 million underlying operating profit, i.e. the debt is at least manageable, but may contribute to share price volatility. No further acquisitions were made in the last financial year, nor does the statement indicate likelihood of such in the foreseeable future, so debt reduction should continue.

Net assets work out at £2,356.3 million - albeit including £2,550.6 million of goodwill - and there is a further £676.2 million of "other intangibles", these being the effect of acquisitions. It implies less downside protection compared with more tangible balance sheets, if the earnings scenario did worsen.

So the group profiles as a typical acquirer with relatively high debt and goodwill/intangibles that also mean a split between headline and normalised profits. But, so long as a majority Conservative government remains in power, Babcock is well-positioned to capitalise on its defence priorities, deriving nearly 80% of revenue from the UK (otherwise a range internationally).

The stock is, therefore, one for patient investors than traders, but which should now overcome a two-year bear phase from about 1,300p if the earnings scenario is reasonably credible.

For more information see their website.

| Babcock International Group - financial summary | Consensus estimates | ||||||

|---|---|---|---|---|---|---|---|

| year ended 31 Mar | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

| Turnover (£ million) | 2,848 | 3,029 | 3,321 | 3,997 | 4,158 | ||

| IFRS3 pre-tax profit (£m) | 173 | 182 | 219 | 313 | 330 | ||

| Normalised pre-tax profit (£m) | 242 | 193 | 244 | 304 | 496 | 536 | |

| Operating margin (%) | 9.4 | 6.6 | 7.3 | 8.0 | |||

| IFRS3 earnings/share (p) | 37.7 | 38.3 | 38.7 | 52.6 | 56.8 | ||

| Normalised earnings/share (p) | 53.8 | 40.7 | 43.6 | 51.0 | 55.8 | 80.0 | 86.0 |

| Earnings per share growth (%) | 119.0 | -24.3 | 7.1 | 17.0 | 9.4 | 43.3 | 7.6 |

| Price/earnings multiple (x) | 18.4 | 12.9 | 12.0 | ||||

| Cash flow/share (p) | 49.7 | 55.1 | 42.5 | 66.3 | |||

| Capex/share (p) | 11.3 | 13.0 | 10.7 | 19.5 | |||

| Dividends per share (p) | 17.5 | 20.5 | 23.7 | 21.9 | 24.1 | 28.6 | 30.7 |

| Yield (%) | 2.4 | 2.8 | 3.0 | ||||

| Covered by earnings (x) | 3.1 | 2.0 | 2.1 | 2.3 | 2.3 | 2.8 | 2.8 |

| Net tangible assets per share (p) | -240 | -223 | -215 | -213 | |||

| Source: Company REFS | |||||||

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.