Persimmon caught up in housing crash fears

5th July 2016 14:20

by Harriet Mann from interactive investor

Share on

Ignoring a decent set of results to focus on uncertainties that lie ahead is sensible behaviour by any investor. And that's what's happened to Tuesday as a first-half update was overshadowed by Aviva Investors's decision to suspend dealing in its £1.8 billion property fund just a day after did the same. Fears about a property crash are growing.

After a high volume of retail client withdrawals, Standard Life's £2.9 billion UK Real Estate fund, which holds a mix of commercial real estate assets, stopped trading on Monday. It takes time to sell commercial property to cover fund withdrawals, but we're told managers will assess the situation every 28 days. Aviva's move also helped tip sterling to below $1.31 and its lowest in 31 years.

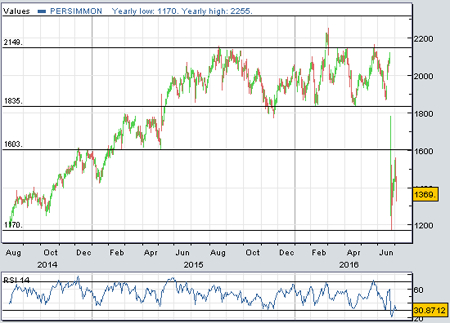

Of course, this will do nothing to help investor confidence in a highly cyclical sector already shaken after the UK's decision last month to leave the European Union. , , and Persimmon, already down around one-third since the EU vote, fell deeper into the red.

Mike van Dulken, head of research at Accendo Markets, said the Standard Life move was "like a red flag to a panicky bull, failing miserably to retain calm among the sector's retail faithful, simply adding fuel to post-Brexit flames of worry".

"Shares off their worst levels, but be careful you don't get burnt."

However, Persimmon's latest results for the six months to 30 June were good. Revenue jumped 12% to £1.5 billion as legal completion volumes rose 6% to 7,238 homes and the average selling price also increased by 6% to £205,500.

Low interest rates and a healthy labour market helped. Mortgage approvals were 18% ahead of last year and visitor numbers are stronger, despite the uncertainty of the European referendum and even against strong comparatives.

With the Bank of England set to cut rates further this summer and possibly lining up a third round of quantitative easing, the cost of borrowing will remain cheap for years to come.

We'll find out more on 23 August when results are confirmed, but construction has started on 35 Persimmon sites. The housebuilder has an active outlet network of 345 sites, including 108 new ones, which should support a higher operating margin compared to the 23% achieved in the second half of 2015.

Persimmon increased its shareholder return plan by £860 million to £2.76 billion in February, promising investors £9 per share by 2021. Even after its accelerated £338 million pay-out in April, the housebuilder's cash pile is two-thirds larger at £462 million.

Of course, nobody has a crystal ball and any forecasts are purely guess work. But Persimmon if confident after decades of chronic undersupply that market fundamentals will remain strong, providing good opportunities for those companies with strong balance sheets.

"Once again, results are worth nada; outlook is king," adds van Dulken. "Share prices quite rightly attribute nearly all importance on future earnings potential rather than historical performance; after all, you can't buy past growth. And investors like corporate uncertainty only marginally more than they liked listening to Chris Evans shouting on a Sunday evening."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.